-

EUR/USD attracts some buyers amid the USD softness.

-

ECB’s de Cos said risks to economic growth remain skewed to the downside.

-

The markets anticipate the Fed to begin cutting rates as early as March, but the Fed’s Williams pushed back against the expectation.

-

The US Consumer Price Index (CPI) for December will be a closely watched event on Thursday.

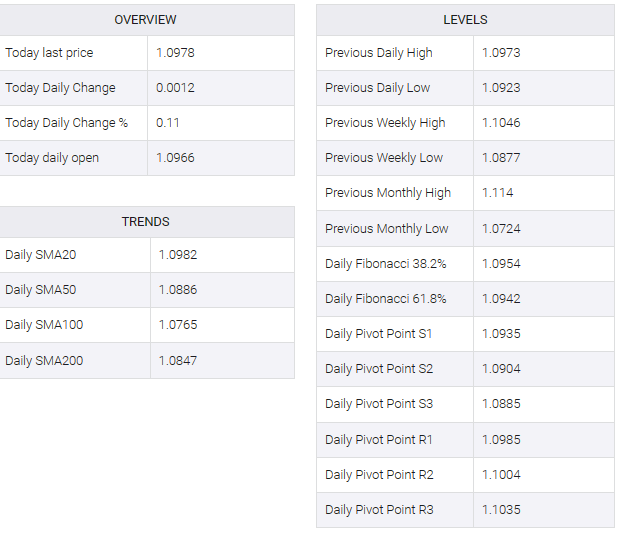

The EUR/USD pair edged higher for a second consecutive day during early Asian trading hours on Thursday. The major pair’s rebound is greatly aided by a softer US dollar (USD). Traders await the release of the US Consumer Price Index (CPI), which is estimated to show a 0.2% MoM and 0.3% YoY rise in December, for fresh stimulus on Thursday. At press time, EUR/USD was trading at 1.0977, up 0.11% on the day.

Late on Wednesday, European Central Bank (ECB) Governing Council member Pablo Hernandez de Cos said the euro area likely failed to grow in the final three months of 2023 and the central bank will focus on various developments in the coming months that could condition. The trajectory of inflation and its monetary policy action

ECB Vice President Luis de Guindos said the eurozone economy may have entered recession in the last quarter and its prospects are bleak. He also supports the current level of interest rates. Meanwhile, ECB member Isabelle Schnabel stressed that the central bank is on the right track in controlling inflation. He cited geopolitical tensions as an upside risk to inflation.

Across the pond, financial markets expect the Federal Reserve (Fed) to start cutting rates as early as March, but New York Fed President John Williams and other officials are pushing back against the idea. Williams said that interest rates in the US will likely remain high “for some time” until the central bank is confident that inflation is returning to 2%.

Industrial output from Spain and Italy, and economic bulletins will be Thursday. However, the American session will be highlighted by the December US CPI report. Traders will take cues from this data and find trading opportunities around the EUR/USD pair.