-

EUR/USD stays calm after pulling back from recent highs as US Dollar improves.

-

Euro advanced by 3.16% against the Greenback in the year 2023.

-

DXY may be retested on the market’s bets on the Fed’s easing in early 2024.

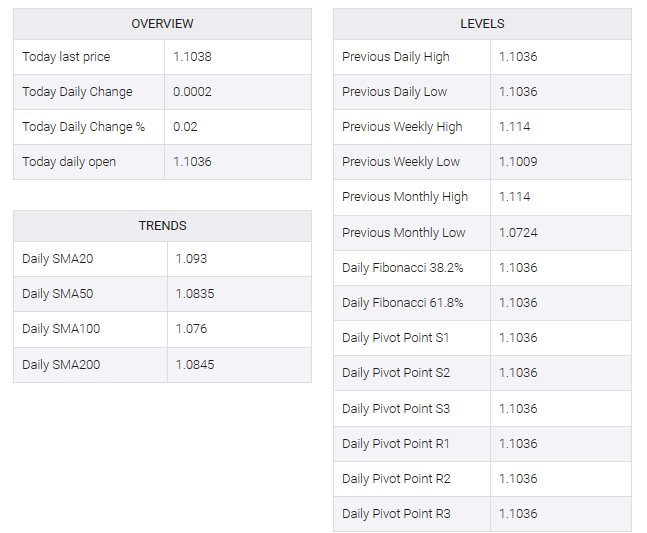

EUR/USD hovered around 1.1030 during the Asian session on Tuesday, retreating from a recent high of 1.1139 reached on Thursday. In 2023, the EUR/USD pair closed at 1.1036, up 3.16% after two consecutive years of decline. The pair has found upside support over the past three months as markets have recently seen a slight decline in United States (US) inflation.

The US Dollar Index (DXY) is trading around 101.40 after posting gains in the recent session. However, DXY faces challenges as markets bet on the US Federal Reserve’s (Fed) ambivalent stance on the path of interest rates through early 2024.

The Chicago Purchasing Managers’ Index released by ISM-Chicago on Friday showed business conditions across Illinois, Indiana and Michigan fell to 46.9 in December from 55.8 previously.

Market participants witnessed a decline in recent US labor data, core PCE inflation and annual GDP. These figures confirm the theory that the US economy is losing momentum in the fourth quarter and is on track for a soft landing. This strengthens the case for a Fed rate cut in 2024 and adds negative pressure on the USD.

In the eurozone, consumer price inflation eased in November but the annual figure remained above the 2.0% target. In contrast, December’s PMI report showed ease in both services and manufacturing. Annual Spanish consumer prices held firm at 3.3%, indicating persistent inflation in certain European countries. This could strengthen the European Central Bank’s (ECB) acquisitive position and provide a solid base for euro support.

Traders await more data from the eurozone, including Friday’s harmonized index of consumer prices data. On the US docket, ISM manufacturing PMI figures and Federal Open Market Committee (FOMC) meeting minutes will be on watch on Wednesday.