-

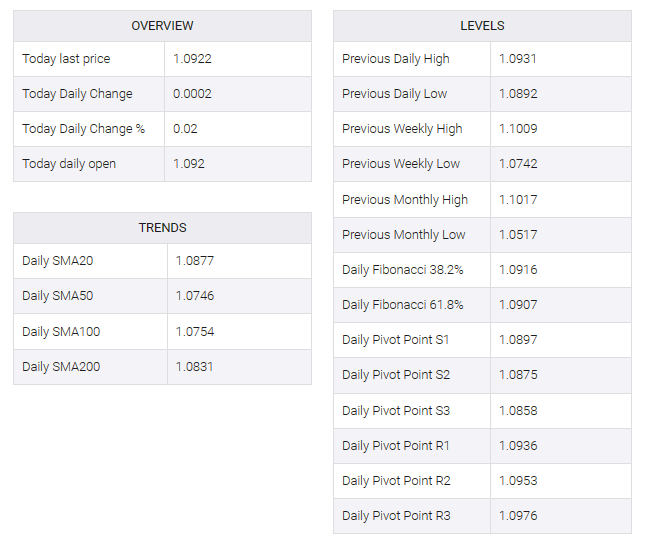

EUR/USD currently trades near 1.0920, adding 0.01% on the day.

-

German business expectations and current conditions unexpectedly worsened in December.

-

The markets believe the Fed is done with the hiking cycle, and three rate cuts are expected next year.

-

Traders await the final reading of the Eurozone HICP and US housing data.

The EUR/USD pair hovers around 1.0920 during the early Asian trading hours on Tuesday. The critical resistance level remains at the 1.1000 psychological mark. Investors will take more cues from November’s Eurozone Harmonized Index of Consumer Prices (HICP) data, which is estimated to remain unchanged at -0.5% MoM while the Core HICP is forecast to stay at 0.6% MoM.

The IFO Institute revealed on Monday that German business expectations and current conditions unexpectedly worsened in December. The German business climate index came in at 86.4 in December versus 87.2 previously, below expectations of 87.8. At the same time the expectations index fell to 84.3 from 85.1. Finally, the current valuation index rose to 88.5 from the previous reading of 89.4, worse than the market consensus of 89.5.

The weaker-than-expected IFO survey contributed to concerns about Germany’s economic slowdown, and the figures indicated a slight contraction in GDP growth in the fourth quarter, which is considered a technical slowdown after two consecutive quarters of negative growth. Germany’s improving economic conditions could sustain the Euro (EUR) upside and act as a headwind for the EUR/USD pair.

On the other hand, Federal Reserve (Fed) Chair Jerome Powell said during the press conference that inflation has come down from its highs and that it has come without a significant increase in unemployment and that is good news. Markets believe the Fed is done with the hiking cycle, and three rate cuts are expected next year.

Nevertheless, the gap between the real rate, the Fed funds rate and inflation remains wide, and the Fed is more likely to hike if inflation data continues to cooperate. Investors will take further cues from Friday’s inflation data for fresh stimulus. The Fed’s preferred gauge of inflation, the core Personal Consumption Expenditures Price Index (PCE), is projected to hold steady at 0.2% MoM in November. On an annualized basis, core PCE is estimated to have grown by 3.3% YoY in November.

Looking ahead, market participants will monitor the final reading of the Eurozone Harmonized Index of Consumer Prices (HICP) for November. On the US docket, building permits and housing starts for November.