-

The Euro trims losses as the US Dollar pulls back ahead of the US CPI release

-

US Inflation and the Fed decision will set the Dollar’s near-term direction.

-

EUR/USD’s immediate trend remains bearish while below 1.0815.

The Euro is moving with a moderately positive tone during the European morning trade, reaching intra-day highs near 1.0800 as the Dollar loses footing ahead of the release of US CPI figures.

US CPI and the Fed will set the Dollar’s direction

Later today, the US Bureau of Labor Statistics will announce that US inflation has eased to 3.!% in the twelve months since November and that core CPI has held steady at 4%.

These figures will be analyzed in particular detail today with all eyes on the Federal Reserve’s monetary policy decision on Wednesday. Investors’ speculation about the timing of the Fed pivot is the main driver behind the FX market and in that context, any surprise in inflation trends can have a significant impact on the US dollar cross.

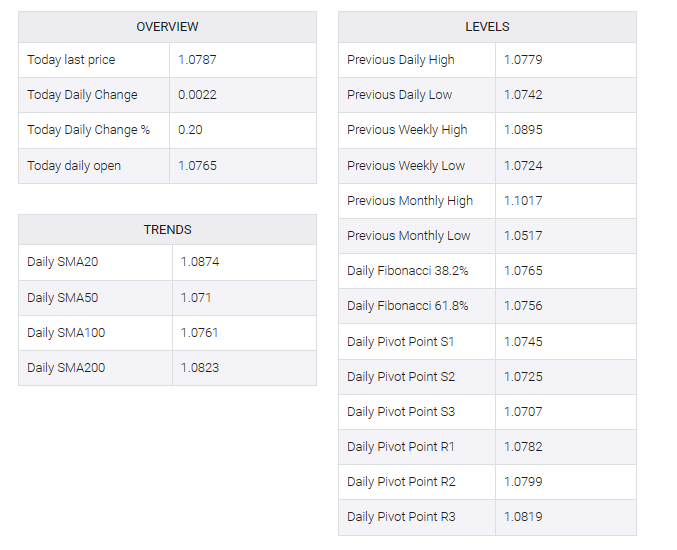

EUR/USD Technical analysis

The pair’s corrective reversal from late November highs has found support on the 50% Fibonacci retracement of the October – November rally, at 1.0730.

The near-term bias remains negative with 1.0815, where previous highs meet the 4h 50 SMA, likely to offer a significant resistance. Above here, 1.0880 will come next.

Supports are at the mentioned 1.0730 and early November lows at 1.0660.