-

EUR/USD holds lower grounds after falling the most in five weeks the previous day.

-

Eurozone inflation halved in the last four months versus January-April period.

-

US Core PCE Price Index appears positive but lacks details to ensure Fed rate hikes.

-

Firmer US employment data eyed to defend higher rates and can weigh on Euro price.

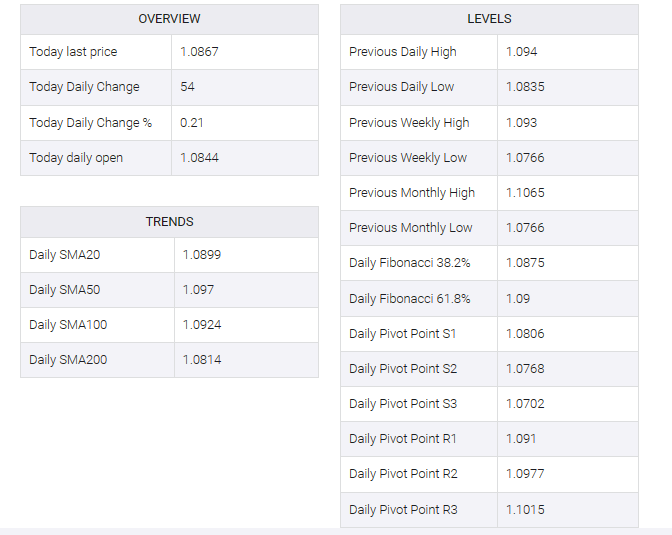

EUR/USD remains depressed around 1.0845 as traders brace for the top-tier US employment details on early Friday. In doing so, the Euro pair struggles for clear directions after declining the most in five weeks the previous day.

That said, eurozone inflation data was mostly positive earlier in the day but the comparable position on a four-month basis challenges European Central Bank (ECB) officials’ pessimistic bias.

On Thursday, inflation in the Eurozone as per the European Central Bank’s (ECB) preferred gauge, i.e. the Harmonized Index of Consumer Prices (HICP), came in at 0.6% MoM vs. -0.1% expected and the previous reading where the YoY figures were revised to 5.3% compared to the 5.1% YoY market estimate. “Over the past four months, average monthly growth in core HICP has slowed to 0.2% m/m, compared to an average of 0.6% m/m in the first four months of this year, indicating a slowdown,” ANZ said after the data.

Further, German retail sales for July -0.8% MoM figures versus 0.3% market forecast, while YoY results look more disappointing as it fell to -2.2% from -1.6% compared to -1.0% expected.

Following the data, the ECB meeting accounts rejected hopes of any surprises from the bloc’s central bank, which in turn weighed on the EUR/USD price against dovish comments from ECB policymaker Robert Holzmann and neutral comments from Isabelle Schnabel.

On the other hand, the Fed’s preferred inflation gauge, the US core Personal Consumption Expenditure (PCE) price index for August, came in at 4.2% YoY and 0.2% MoM versus market forecasts of 4.1% and 0.2% respectively. Further, initial jobless claims fell to 228K from 232K earlier (revised) versus the market forecast of 235K while the Chicago PMI rose to 48.7 for August compared to 44.1 expected and a previous reading of 42.8. Additionally, personal spending exceeded the expected 0.6% for July and the previous reading of 0.8% while personal income fell to the market forecast of 0.3% for the month and the previous reading of 0.2%.

Among those plays, U.S. 10-year and two-year Treasury bond yields remained depressed near three-week lows while U.S. stock futures edged lower after a mixed Wall Street close. With that, initial details for Euro buyers were positive if there are no big surprises from the US NFP and unemployment rate roll out, though the EUR/USD bears may struggle ahead of the data.

Also Read: Nonfarm Payrolls Preview: Four Scenarios for a Jobs Report to Test U.S. Economic Resilience

Technical analysis

The EUR/USD pair’s U-turn from the 100-DMA, around 1.0925 by the press time, lures the Euro bears to again poke the 200-DMA support of around 1.0815.