-

EUR/USD remains confined in a narrow trading band for the second straight day.

-

The technical setup warrants some caution before placing fresh directional bets.

-

Traders now look to the US CPI for fresh impetus amid dovish Fed/ECB pricing.

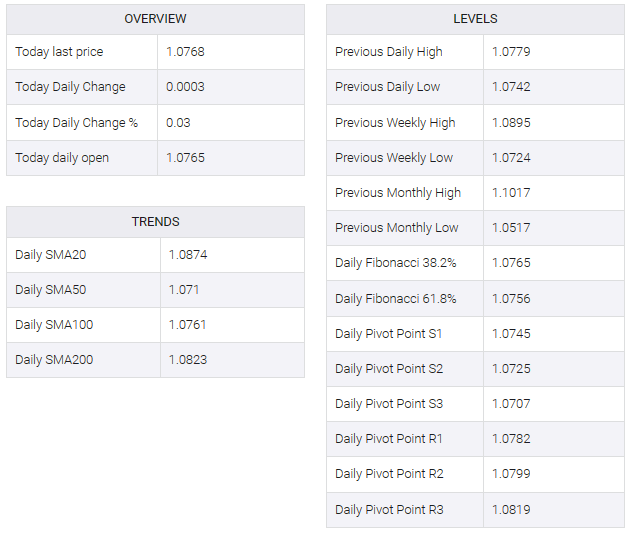

The EUR/USD pair extends its sideways consolidative price move for the second successive day on Tuesday and remains well within the striking distance of the monthly low, around the 1.0725-1.0720 region touched last week. Spot prices currently trade around the 1.0765-1.0770 area, nearly unchanged for the day, as traders keenly await the release of the US consumer inflation figures for a fresh impetus.

In the run-up to key data risks, reduced bets for the first interest rate cut by the Federal Reserve (Fed) in March 2024 acted as a tailwind for the US dollar (USD). The shared currency, on the other hand, was weakened by speculation that the European Central Bank (ECB) may start cutting interest rates early next year amid a bigger-than-expected fall in eurozone inflation last month. This, in turn, prevents traders from placing aggressive directional bets around the EUR/USD pair and leads to a subdued range-bound price action.

From a technical perspective, spot prices on Friday showed resilience below the 50% Fibonacci retracement level of the October-November rally and so far, managed to defend the 100-day Simple Moving Average (SMA) on a daily close. This makes it wise to wait for a permanent break and take below the 1.0725 area before positioning for an extension of the recent pullback from the multi-month peak touched in November. The EUR/USD pair could then weaken below the 1.0700 mark and test the 61.8% Fibo. level, near the 1.0670-1.0665 zone.

On the flip side, the 1.0800 round figure corresponds to the 38.2% Fibo. The breakpoint, now around the 1.0825 region seems to be acting as an immediate strong barrier ahead of the 200-day SMA. Some follow-through buying is likely to push the EUR/USD pair closer to the 1.0900 mark. The momentum can be further extended towards the next relevant barrier near the 1.0940 horizontal zone, above which the bulls can make a new attempt to conquer the 1.1000 psychological mark.