-

EUR/USD is bidding an inventory distribution level near a two-decade low at around 0.9900.

-

A bear cross, represented by 20-and 50-EMAs, adds to the downside filters.

-

The RSI (14) has shifted into the bearish range of 20.00-40.00 that indicating more weakness ahead.

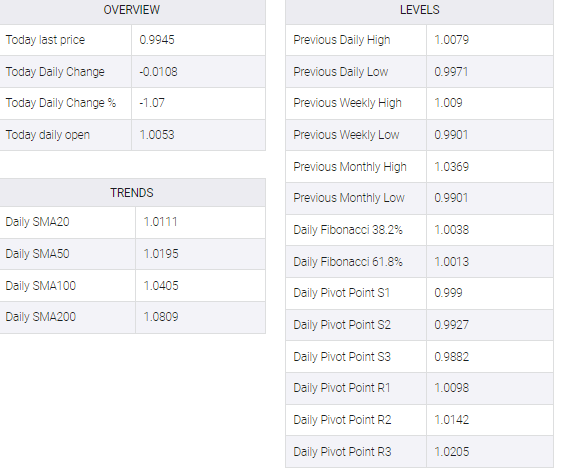

The EUR/USD pair is displaying a lackluster performance after failing to overstep the immediate hurdle of 0.9960 in the late New York session. The asset witnessed a steep fall on Thursday after surrendering the 1.0000 magical figure. Currently, the overall price action indicates that 1.0000 will remain a dream level for the EUR/USD pair as the asset is gearing up for a fresh bearish impulsive wave.

On the hourly scale, the asset has already halted a tad-wider consolidation formed in the 0.9900-1.0095 range. The asset is trading around lows and failure to achieve a reversal indicates inventory distribution for the worse. A decisive break below the consolidation will trigger the volatility extension.

A bearish cross represented by the 20- and 50-period exponential moving averages (EMAs) at 1.0016 indicates further weakness ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00 after remaining in the neutral range of 40.00-60.00 for a tad longer period. This has triggered a fresh downside move ahead.

A decisive drop below Thursday’s low at 0.9910 will drag the asset towards the round-level support at 0.9800 followed by the 1 January 2001 high at 0.9600.

Alternatively, the shared currency bulls could regain their glory if the asset oversteps the August 26 high at 1.0090. An occurrence of the same will send the major towards August 17 high at 1.0203 and August 4 high at 1.0254.