-

EUR/USD climbs above the 1.0900 mark on Thursday ahead of the Eurozone PMI data.

-

The bullish outlook of EUR/USD remains intact as the major pair holds above the 50- and 100-hour EMA.

-

The first resistance level is seen at 1.0965; 1.0870 acts as an initial support level for the pair.

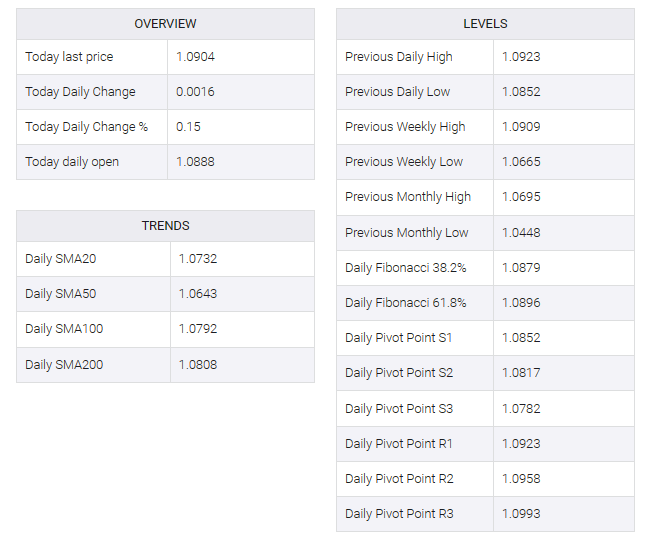

The EUR/USD pair snapped its two-day losing streak and climbed above 1.0900 during the Asian session on Thursday. Traders will closely watch Eurozone preliminary PMI data and ECB minutes on Thursday. Markets remain muted on Thursday due to the Thanksgiving Day holiday in the US. The major pair is currently trading near 1.0905, up 0.16% on the day.

From a technical perspective, EUR/USD’s bullish potential remains intact as the major pair remains above the 50- and 100-hour exponential moving averages (EMA) on the four-hour chart. Additionally, the Relative Strength Index (RSI) stands in bullish territory above 50, which supports buyers for now.

The first upside barrier for EUR/USD is seen at 1.0965, which represents the confluence of the upper boundary of the Bollinger Bands and the November 21 high. The key resistance level is near a psychological round figure and will emerge at the August 11 high of 1.1000. A decisive break above the latter would see the rally on its way to the August 4 high at 1.1042, the July 27 high at 1.1149.

.

On the flip side, the lower limit of the Bollinger Band at 1.0870 acts as an initial support level for the major pair. The additional downside filter to watch is near the 50-hour EMA and a low of November 22 at the 1.0850-1.0860 zone. Further south, the next contention level is located at the 100-hour EMA at 1.0790. A breach of the latter will see a drop to a high of November 9 at 1.0725.