-

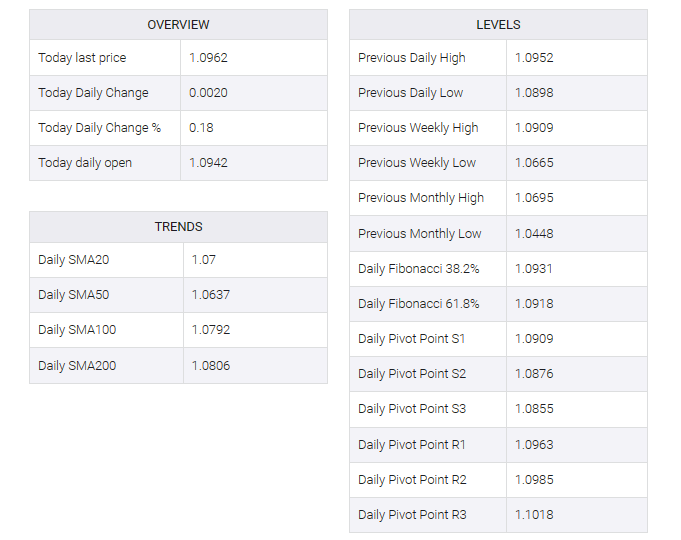

EUR/USD extends its upside above 1.0950, up 0.18% on the day.

-

The pair holds above the 50- and 100-hour EMA with the overbought RSI condition.

-

The first upside barrier is seen at 1.0978; the 1.0895–1.0900 zone acts as an initial support level for the pair.

The EUR/USD pair traded in positive territory for the fourth consecutive day during the early European session on Tuesday. A weaker US dollar and lower US Treasury bond yields give EUR/USD some support. Investors will take further cues from the Federal Open Market Committee (FOMC) meeting minutes on Tuesday, which could potentially provide insight into the future path of policy rates.

According to the four-hour chart, EUR/USD’s bullish potential remains intact as the major pair remains above the 50- and 100-hour exponential moving averages (EMA). It is worth noting that the Relative Strength Index (RSI) above 50 is in bullish territory. However, overbought RSI conditions indicate that further consolidation cannot be ruled out before positioning for any near-term EUR/USD appreciation.

That being said, EUR/USD’s immediate resistance level is seen near the upper boundary of the Bollinger Bands at 1.0978. Critical upside barriers are located near a psychological round figure and the August 11 high at 1.1000. Any follow-through buying would see a rally to the August 4 high of 1.1042, en route to the July 27 high of 1.1149.

On the downside, the 1.0895-1.0900 zone serves as the primary support level for the major pair. The mentioned level is the confluence of psychological signs and the November 16 high. Further south, the next level of contention will emerge near the lower end of the Bollinger Bands at 1.0817. A break below the latter would come down to the 50-hour EMA at 1.0759, followed by the November 9 high at 1.0725.