-

EUR/USD drifts lower to 1.1028 amid the rebound of the USD.

-

EUR/USD maintains the bearish outlook above the key EMA; RSI indicator stands in bearish territory below the 50 midline.

-

The key support level to watch is seen at 1.1000; 1.1080 acts as an immediate resistance level for the major pair.

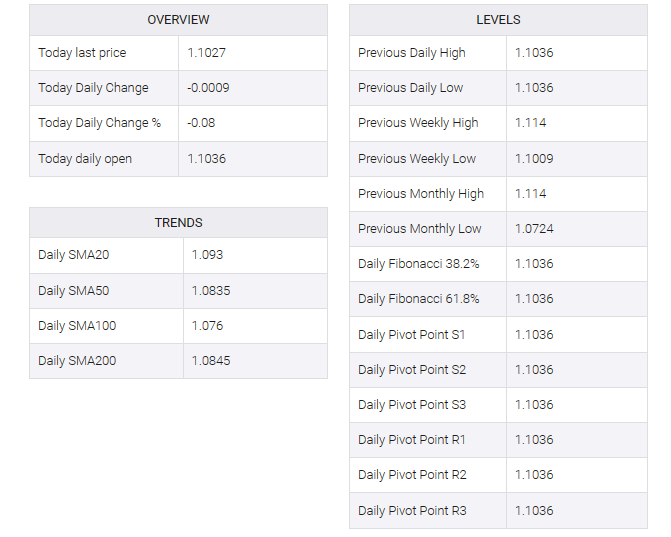

The EUR/USD pair lost momentum for the fourth consecutive day in the early European session on Tuesday. The major pair’s downtick has been supported by the recovery of the US Dollar (USD). At press time, EUR/USD is trading at 1.1028, down 0.07% on the day.

From a technical perspective, EUR/USD remains bearish on the four-hour chart as the major pair remains below the key 100-hour exponential moving average (EMA). However, the 14-day Relative Strength Index (RSI) stands in bearish territory below the 50 midline, indicating that further declines cannot be ruled out.

Key support levels to watch are the confluence of the lower end of the Bollinger Bands and the psychological round mark at 1.1000. The next level of contention is seen at the 100-hour EMA at 1.0973. Further south, downside stops are located at 1.0929 (December 20 low), then 1.0888 (December 15 low).

On the upside, a high of December 29 at 1.1080 acts as an immediate resistance level for the major pair. The next hurdle will emerge at the 1.1100 psychological round mark. The additional upside filter to watch is 1.1139 (High of December 28), en route to 1.1240 (High of July 19).