-

EUR/USD gains upward traction as the US Dollar declines on improved risk appetite.

-

The breakthrough above the barrier at 1.1000 could lead the pair to revisit the previous week’s high at 1.1038.

-

The major support at 1.0950 could be retested as MACD suggests tepid momentum.

EUR/USD extended its gains for a second straight day, trading around 1.0980 in the Asian session on Thursday. The EUR/USD pair finds upside support as the US Dollar (USD) faces challenges in risk-on market mood ahead of US Consumer Price Index (CPI) data.

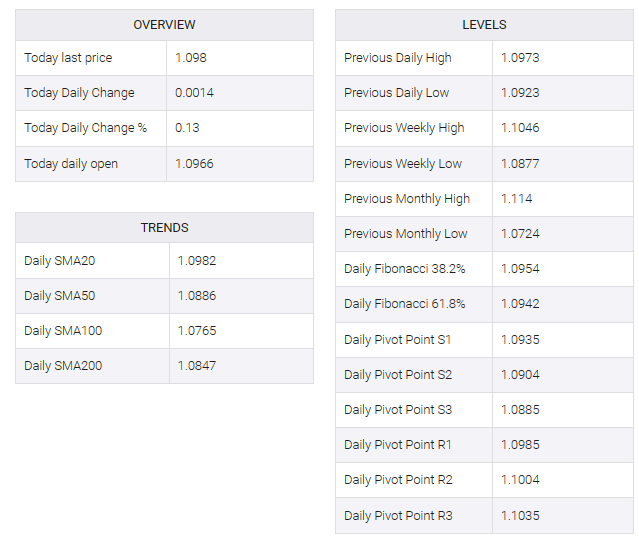

The EUR/USD pair may face resistance at the psychological level of 1.1000. If there is a breakthrough above this level, it could potentially support the pair to revisit the previous week’s high at 1.1038. Notably, the 14-day Relative Strength Index (RSI) for the EUR/USD pair has moved back above the 50 mark, indicating a bullish momentum in the market.

However, the moving average convergence divergence (MACD) line, although positioned above the centerline, is still below the signal line. This suggests a lower momentum in the EUR/USD pair. Traders can exercise caution and wait for confirmation before making a decision on the pair, considering the mixed signals given by the lagging indicator.

On the downside, the EUR/USD pair may revisit the immediate support at the key level of 1.0950, later testing the psychological level of 1.0900. A decisive breach of the latter could intensify downward pressure on the pair, potentially leading it to the 50-day exponential moving average (EMA) at 1.0888 and the 38.2% Fibonacci retracement level at 1.0867. A further downside could lead to a significant support level at 1.0850.