-

EUR/USD falls back from 20-DEMA as the risk-aversion theme strengthens.

-

The US Dollar appeal improves due to some increment in the odds of one more interest rate increase from the Fed.

-

The ECB is expected to maintain interest rates steady at 4.5% to avoid a slowdown.

The EUR/USD pair retreated after a short-term pullback near 1.0550 moved in the European session. The major currency pair faced a sharp sell-off as demand for the US dollar improved amid deepening tensions in the Middle East and some growth on expectations of another interest rate hike from the Federal Reserve (Fed) by the end of the year.

The US dollar index (DXY) recovered strongly near 106.60 and is expected to expand further as the US remains resilient compared to other economies, which are struggling to absorb the consequences of higher interest rates by central bankers.

Meanwhile, the European Central Bank (ECB) is expected to keep interest rates unchanged in November as the eurozone economy continues to struggle with weak economic prospects. To protect the divided continent from recession, the ECB is expected to keep interest rates steady at 4.5%.

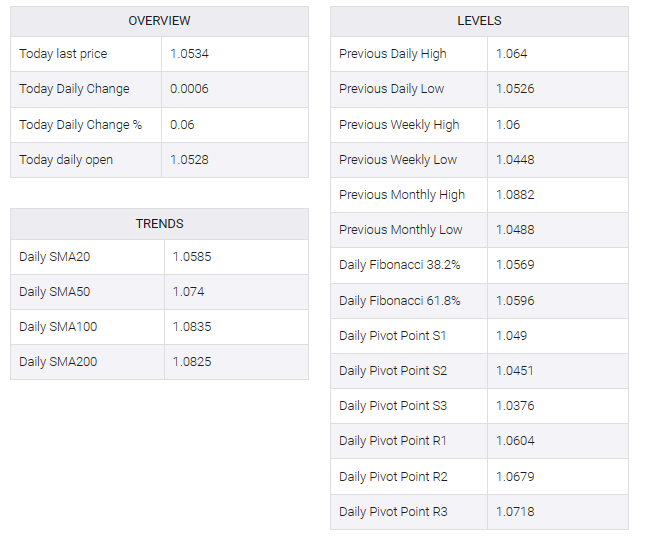

EUR/USD dropped vertically after a less confident pullback near the 20-day exponential moving average (EMA) near 1.0600. The shared currency pair is trading near the horizontal support of the widening triangle chart pattern, plotted at the 1.0482 high from November 14. The upward sloping trend of the chart pattern mentioned above has been placed at the high since February 2 at 1.1033.

The Relative Strength Index (RSI) (14) struggles to rise to 40.00-60.00. A similar failure would indicate that downward momentum has strengthened.

If the asset falls below 1.0448 on October 3 then a fresh downside could be seen. This will reveal a new 10-month asset low near 1.0400. A slippage below the latter would pave the way for the 11 Nov 2022 high of 1.3642.

On the upside, a recovery above the Oct. 12 high of 1.0640 would drive the asset to a low near 1.0700 on Sept. 6, followed by a Sept. 20 high of 1.0737.