-

EUR/USD hovers around 1.0565 amid the USD weakness, lower US bond yield.

-

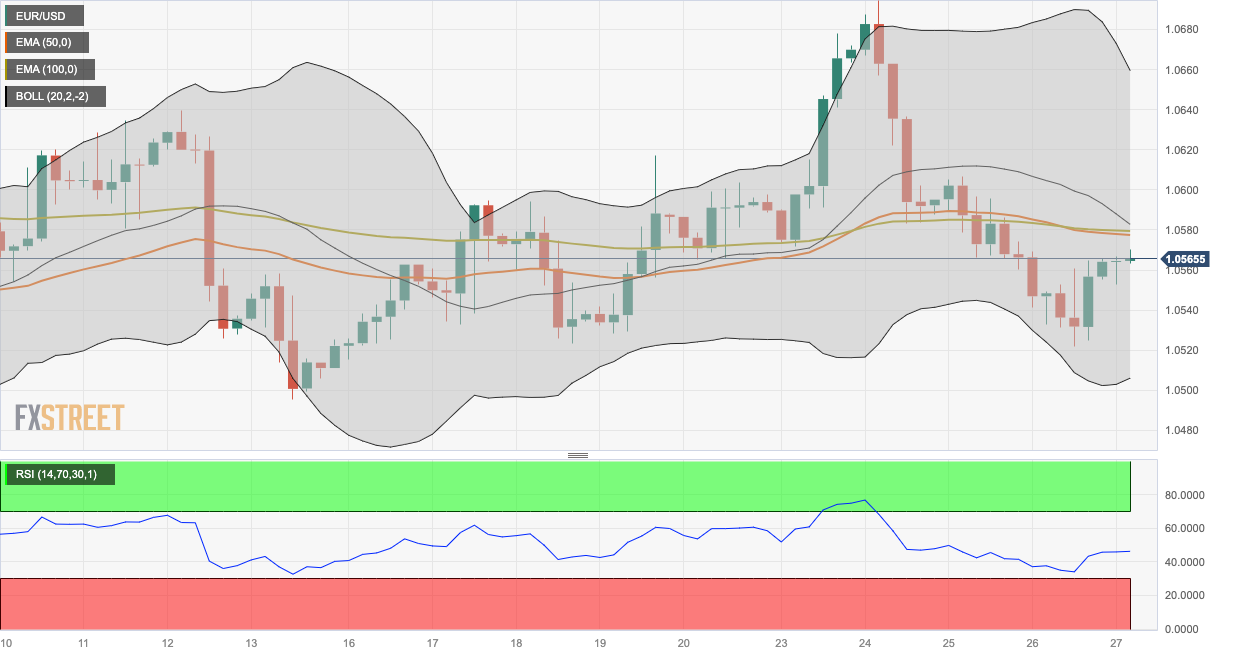

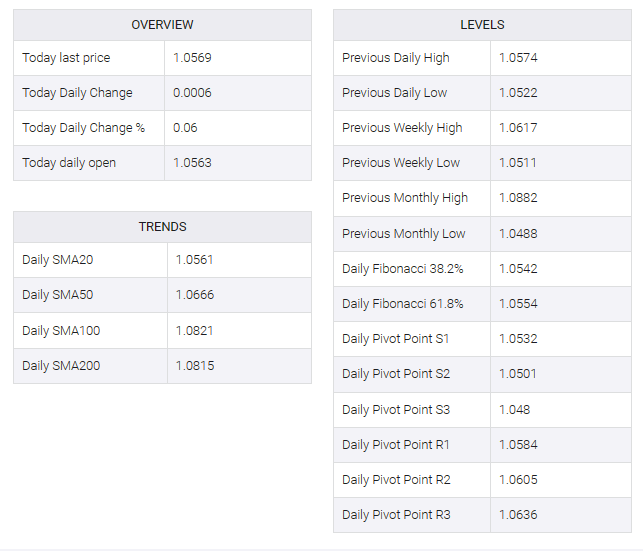

The pair holds below the 100- and 200-hour EMAs; the RSI indicator is located in bearish territory under 50.

-

The first resistance level is located at 1.0580; 1.0522 acts as the initial support level.

During the European session on Friday the EUR/USD pair recovered some lost land from the middle of the -1.0500. The Lower US Treasury Bond yields the US dollar (US dollar) Lower, which acts as a telwind for the Euro/USD pair.

On Thursday, the European Central Bank (ECB) decided to leave the interest rate unchanged as much expected. ECB president Christine Legard said that holding the central bank rate does not mean that they will never grow again. Legard also said that the risk of economic growth is leaning towards downside.

According to the four-hour chart, the EUR/USD pair holds 100- and 200-hourlphensional movements below the average (EMA), at least refers to the resistance path as follows. It is noteworthy that the relative energy index (RSI) is located in the Bareish region under the age of 50, which supports sellers in the nearest term.

The first opposite barrier for the main pair is located near the 100-EMA at 1.0580. Any follow-up purchase rally on the upper boundary of the Bolinggar band of 1.0660 will look at 1.0694 (high October 24), then 1.0735 (September 20 high).

On the other hand, 1.0522 acts as the initial support level for EUR/USD. The key contention level is seen at the 1.0500-1.0505 region, portraying the confluence of the lower limit of the Bollinger Band and a psychological round figure. A decisive break below the latter will see a drop to 1.0450 (a low of October 4).