-

EUR/USD treads water near 1.0920 to retrace its recent losses.

-

Traders may wait for confirmation as MACD indicates a potential shift to a downward trend for the pair.

-

A break below 1.0900 could lead the pair to approach the 50-day EMA at 1.0878 and 38.2% Fibonacci retracement at 1.0867.

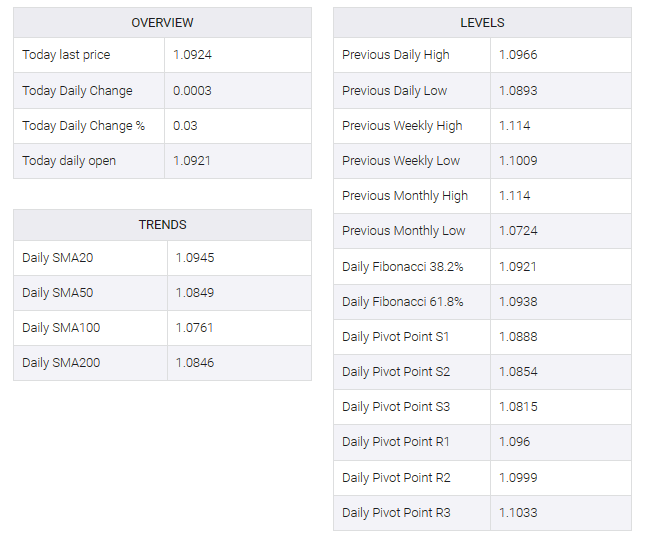

EUR/USD is trying to recover its recent losses, trading near 1.0920 in the Asian session on Thursday. The EUR/USD pair faces downward pressure as the US dollar (USD) strengthens as markets shift to caution amid global growth concerns towards the end of 2024.

The 14-day Relative Strength Index (RSI) is hovering below the 50 mark, indicating a bearish sentiment in the EUR/USD pair. Traders can be cautious and wait for confirmation from the lagging indicator Moving Average Convergence Divergence (MACD). The MACD line is above the center line but shows a deviation below the signal line, suggesting a possible shift towards a downtrend for the EUR/USD pair.

The EUR/USD pair may find a key support around the psychological level at 1.0900. A firm break below the latter could put downward pressure on the EUR/USD pair to navigate the 50-day exponential moving average (EMA) at 1.0878, followed by the 38.2% Fibonacci retracement at 1.0867 and key support at the 1.0850 level.

On the upside, the key level at 1.0950 could act as immediate resistance for the EUR/USD pair. A breakthrough above the level could help the pair explore the territory around the psychological level at 1.1038, the weekly high at 1.1000.