-

EUR/USD consolidates its recent gains to over a two-week high touched on Wednesday.

-

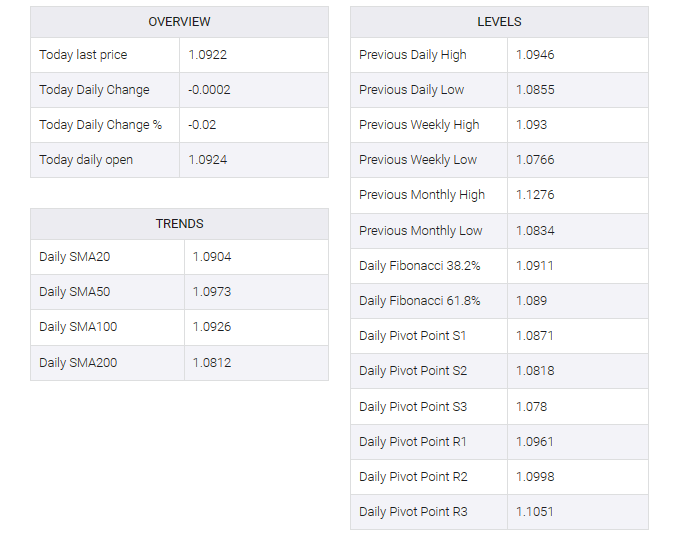

The USD stalls its recent decline near the 200-day SMA support and acts as a headwind.

-

The downside seems cushioned as traders await the release of the US PCE Price Index.

The EUR/USD pair oscillated in a narrow trading band through the Asian session on Thursday, consolidating its recent gains to the two-and-a-half-week high touched earlier in the day. The spot price currently trades below the 1.0900 mid-range and is at the mercy of US Dollar (USD) price movements.

The USD index (DXY), which tracks the greenback against a basket of currencies, found some support near the all-important 200-day simple moving average (SMA) and, for now, seems to have stalled its recent pullback from nearly three months higher. , is seen as a key factor acting as a tailwind for the EUR/USD pair, although the Federal Reserve (Fed) should be expected to halt its rate-hiking cycle to keep a lid on any meaningful upside for the buck and limit the downside. help to do

Investors now seem convinced that the US central bank will soften its dovish stance, and bets have been lifted by disappointing US macro data released on Wednesday. In fact, ADP reported that US private-sector employers added 177K jobs in August, down from a downwardly revised reading of 324K the previous month. Adding to that, the second estimate shows that the US economy grew at a 2.1% annual pace in the second quarter, compared to the original reading of 2.4%.

On the other hand, the shared currency could get support from the European Central Bank (ECB) reviving bets for further interest rate hikes. Bets were lifted by Germany’s latest consumer inflation figures on Wednesday, which showed the annual Harmonized Index of Consumer Prices (HICP) rose 6.4% in August, compared to expectations of 6.2%. It added that the core inflation rate, which excludes volatile items such as food and fuel, remained unchanged from July.

The aforementioned fundamental background supports the possibility of some deep-buying around the EUR/USD pair and warrants some caution before confirming that the recent bounce from the June 13 lows has run out of steam. Market participants are now looking ahead to the US economic docket, which includes the release of the key PCE price index – the Fed’s preferred inflation gauge – and weekly initial jobless claims, later in the first North American session.

The data, along with US bond yields and broader risk sentiment, will drive USD demand and provide some impetus to the EUR/USD pair. However, the focus will remain on the closely watched US monthly employment report, known as Friday’s NFP report.