-

EUR/USD declines over 0.20%, hits daily low of 1.0723 post-US Nonfarm Payrolls; trims losses to 1.0767 after upbeat UoM Consumer Sentiment.

-

US Bureau of Labor Statistics reveals a resilient job market, adding 199K employees, lowering the Unemployment Rate to 3.7%.

-

University of Michigan (UoM) Consumer Sentiment beats estimates while inflation expectations slide.

The EUR/USD fell decently more than 0.20% during the North American session after it dived to a daily low of 1.0723 courtesy of a slid US Nonfarm Payrolls report. However, after a better-than-expected University of Michigan Consumer Sentiment report, the pair has trimmed some earlier losses. The major is trading at 1.0747.

EUR/USD dropped as US Nonfarm Payrolls exceed estimates, but UoM Consumer Sentiment provides relief

A busy economic calendar in the US keeps EUR/USD traders entertained. Earlier, the Bureau of Labor Statistics (BLS) revealed that the economy remained resilient, as the labor force added 199K workers, beating forecasts of 180K. At the same time, the unemployment rate fell from 3.9% to 3.7%, while average hourly earnings remained unchanged at 4%.

The US dollar gathered traction on the data release, as EUR/USD fell to its daily lows before paring those losses. The US Dollar Index (DXY), which tracks the currency’s performance against six others, rose 0.40% to 103.07.

The University of Michigan (UoM) Consumer Sentiment recently showed that American households have become optimistic, snapping a four-month decline. The index rose to 69.4, the highest since August, beating estimates of 62.0 when inflation expectations slipped. Americans estimate inflation at 3.1% over the twelve months, down from 4.5%, while for the five years, 2.8% is projected, down from 3.2% in November.

Across the Atlantic, inflation in Germany as measured by the HICP came in at 2.3%, down from the previous month’s forecast of 3%. That opens the door for a less hawkish response from the European Central Bank (ECB), which is expected to hold its monetary policy meeting next week.

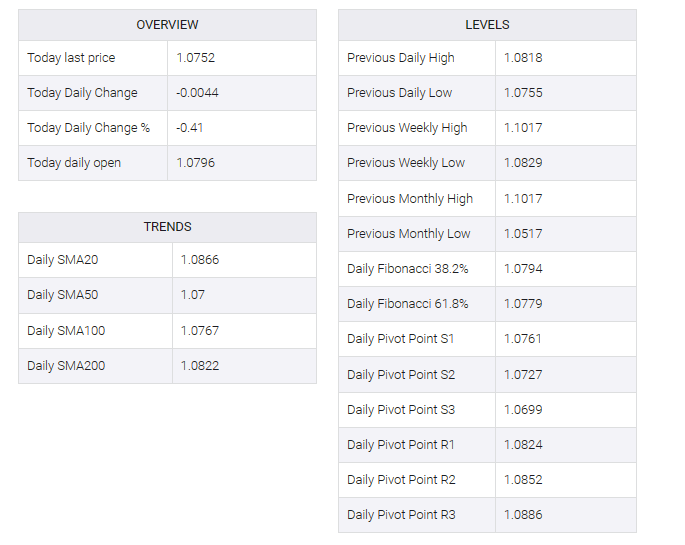

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart portrays the pair as neutral to downward biased, with sellers in charge, as they dragged the exchange rate below the 100-day moving average (DMA) at 1.0762. A daily close below that level can pave the way toward the 50-DMA at 1.0700. A breach of the latter will expose the November 10 swing low of 1.0655. Conversely, an uptrend resumption could happen if traders reclaim the 100-DMA, opening the door for a rally to 1.0800.