-

The EUR/USD spikes down after better-than expected US payrolls data.

-

Nonfarm payrrolls and hourly earnighs increase bayond expectatios in November.

-

US data cools holes of Fed cuts and sends the USD higher.

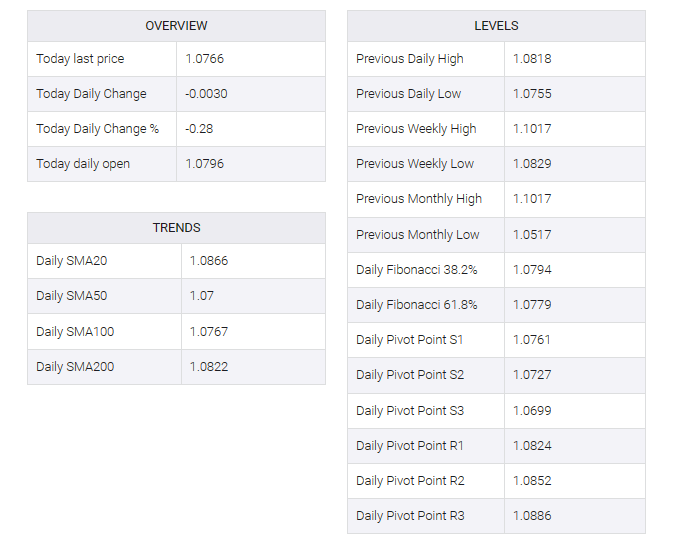

The Euro has dropped more than 40 pips to hit a fresh three-week low below 1.0750 as the US Nonfarm Payrolls report has cooled hopes of Fed rate cuts in early 2024.

Nonfarm Payrolls data cools hopes of Fed cuts

The US economy added 199,000 jobs in November, more than the 1800,00 reading forecast by market analysts and more than the 150,000 jobs created in October.

Beyond that, hourly earnings grew at a 0.4% pace, slightly faster than the 0.3% market expected. It revealed that the US labor market remained strong, countering uncertainties posed by weak JOLT and ADP and dimming investors’ hopes that the Fed could start easing its monetary policy in March.

The market reaction supported the US dollar, sending EUR/USD to fresh lows below 1.0750 although the pair pared some losses shortly afterwards.