-

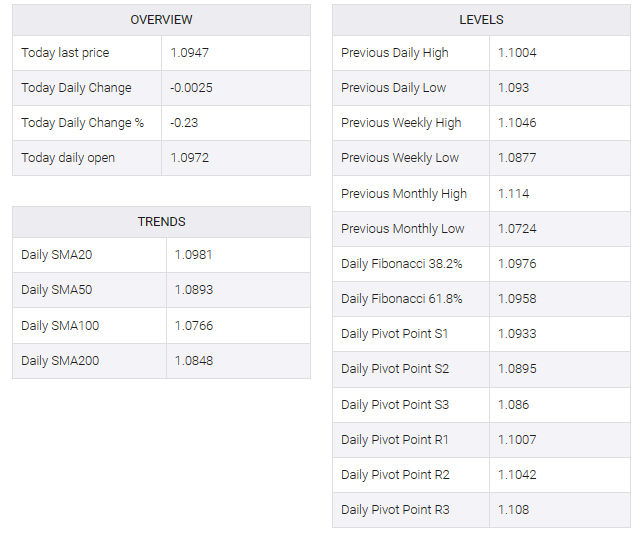

EUR/USD falls sharply below 1.0950 on deepening geopolitical tensions.

-

Fears of widening conflicts in Middle East region have improved the safe-haven appeal.

-

The ECB is not required to raise interest rates further.

The EUR/USD pair slipped below the key support of 1.0950 as market sentiment turned risk-averse amid deepening tensions in the Middle East. Major currency pairs were hit hard as demand for safe haven assets increased significantly.

S&P500 futures suffered significant losses in the late European session, indicating a sharp decline in risk-appetite among market participants. Fears of escalating conflicts in the Middle East region after US airstrikes on Iran-backed Houthi rebels in retaliation for attacks on commercial oil shipments from the Red Sea dampened market sentiment.

The US Dollar Index (DXY) rebounded sharply above 102.50, supported by higher US inflation and geopolitical tensions. US headline inflation accelerated sharply in December amid rising rent prices and health care costs. However, bets supporting a rate cut by the Federal Reserve (Fed) in March are still strong.

According to the CME Fedwatch tool, the odds are slightly above 68% in favor of cutting rates by 25 basis points (bps) in March.

Meanwhile, investors await the US producer price index (PPI) data for December, which will be released at 13:30 GMT. Annual headline PPI is forecast to rise strongly by 1.3% versus a 0.9% gain in November. Over the same period, core PPI excluding volatile food and oil prices is seen to have declined to 1.9% against 2.0%.

On the Eurozone front, European Central Bank (ECB) President Christine Lagarde confirmed that the central bank is done with raising interest rates. He added that the worst of inflation is behind us but if the central bank is confident that inflation will come down to 2%, rates will be cut. Asked about the economic contraction, Lagarde said the euro zone is not in an official recession.