Market News

Economic announcements usually include specific factors when they advise traders about recent developments in the Forex Market News. This could affect the sentiment of markets, in particular, if the data announcement isn’t in line with what traders had been anticipating.

News trading strategy for Forex Market News

The news-based trading method involves trading based on Forex Market News expectations before and following the release of a news announcement. The trading of news announcements could require swift decisions because the financial markets could be affected in a matter of minutes. Thus, you’ll have to make quick decisions on what you can do to trade on the news announcement.

If you are trading on the news release, it’s essential to know how Forex Market News function. Sometimes, the news is already incorporated into the asset’s price. It happens because traders try to anticipate the outcome of Forex Market News announcements in the future, and, as a result, markets react by altering the value of the asset. The news-based market is particularly useful when volatile markets, such as crude oil trades.

Find out more about an analysis of fundamentals when evaluating external influences as part of your strategy for trading news (Forex Market News).

How do you trade the Forex Market News?

- Sign up for the account with CMC Markets. You’ll have access to an initial demo account to practice using virtual funds before depositing funds or placing live trades.

- Keep abreast of the world of finance. The information and research section is updated daily with news (Forex Market News) and analysis about the share, Forex commodities, treasury, and index markets written by There Forex Market News analysts.

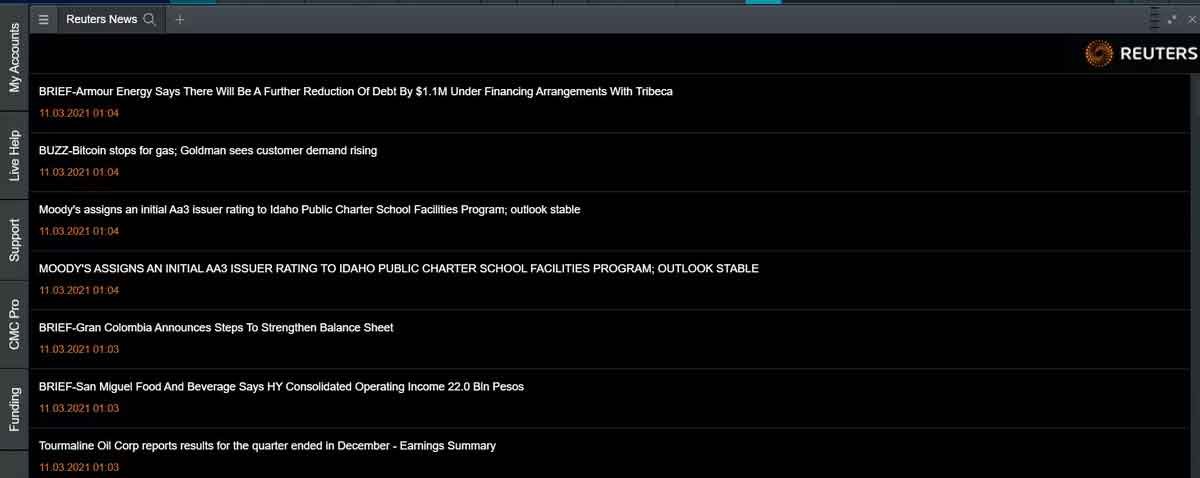

- Please take advantage of there exclusive Forex Market News and insight tools. Live accounts will grant the user access to Morningstar equity research and Reuters news headlines that give you a wealth of data on all kinds of asset classes.

- Explore the best trading strategies to suit your market. This list of the top popular trade strategies includes fundamentals for long-term trading and short-term price actions strategies.

- Examine the possibility of combing fundamentals and techniques. The two kinds of analysis can be more effective when utilized together instead of using one type of analysis for any trading decision.

Forex Market News is traded in the Forex market.

Forex Market News may be particularly active before or following significant economic news events like other types of assets. But, there are some significant differences in the news that distinguishes the Forex market from other financial markets.

Forex Market News tend to respond most strongly to macroeconomic news, affecting or reflecting large economies. In general, Forex traders can look at economic news to determine its impact on interest rates and monetary policy. Information indicating a more aggressive (aggressive) central bank is likely to cause foreign exchange pairs upwards compared to other currencies, whereas the opposite is true. (peaceful) the news may make a currency appreciate.

The currencies of countries that export many commodities or raw materials may be affected by news regarding Forex Market News as they affect the prices of the primary commodities they manufacture. These currencies are frequently called resources currencies. The prices of commodities that impact these currencies are influenced by demand and supply.

For supply-side news, data that indicates an easing of supply could raise prices, while reports that suggest a greater supply could lower prices, which could then affect related currencies.

Information that may reflect shifts in supply can include conflicts, political tensions or terrorism, weather economic sanctions, labor relations (strikes), and many more. Pricing and speculation related to demand depend on the major news (Forex Market News) announcements mentioned earlier, along with commodities inventory reports and forecasts.

Strategy for trading news in Forex Market (Forex Market News)

To create a complete strategy for trading in Forex Market News by utilizing news releases, Forex traders will look for specific indicators of Forex that could affect interest rate speculation, such as:

- Speeches and decisions of the central bank

- Inflation rates

- GDP Gross Domestic Product (GDP) numbers

- Employment statistics

- Trade balances

The Forex Market News surrounding market sentiment can influence how currency traders trade, particularly those that are believed to be safe havens such as the gold commodity and important currencies like USD, JPY, and CHF. These currencies can draw capital in periods of instability and see exodus when the market is calm.

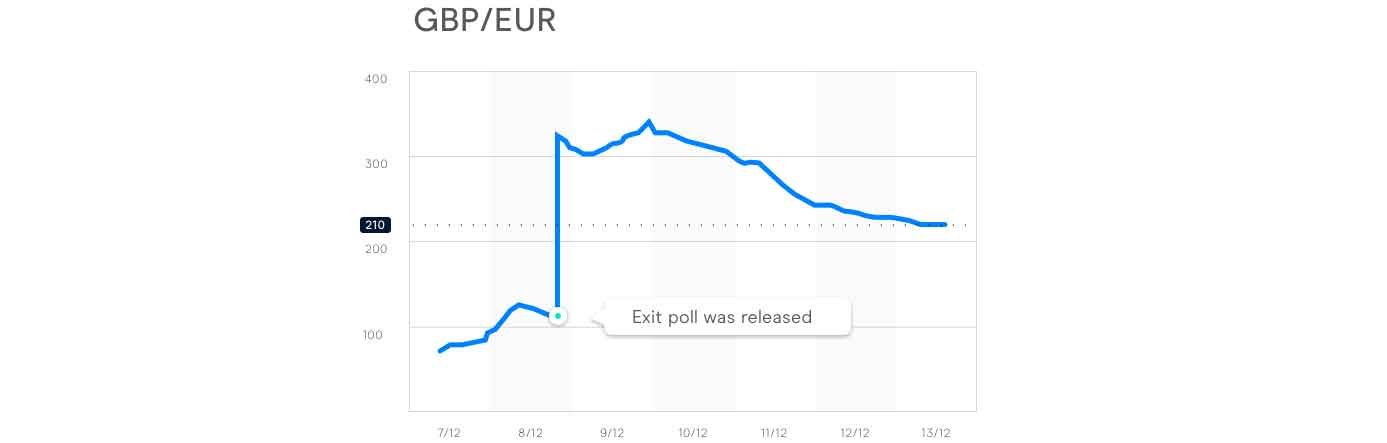

Information that could affect the risk-on and risk-off trades include the stock market’s fluctuations and returns, as well as financial stress on a continental or national scale, political turmoil, and elections, negotiations on treaties, and other general Forex Market News that goes that go beyond the central banks and data on economics. Some recent examples are the Greek debt crisis and China market chaos.

About Forex Market News

The traders should be aware that the demand for many commodities – and consequently the price of commodities fluctuates with seasons. However, the news about seasonal Forex Market News and its impact is typically observed in agricultural and energy commodities, less than for precious metals.

The following table lists some of the most important commodities and resource currencies that impact their impact. Who can utilize them for traders to use as a kind of news (Forex Market News) trading signal for Forex Market News because it helps determine where the currency’s price will go.

|

Country

|

Currency pair | Commodity product |

|---|---|---|

|

Canada

|

USD/CAD | WTI crude oil and metals |

|

Australia

|

AUD/USD | Base metals and grains |

|

New Zealand

|

NZD/USD | Livestock and dairy |

|

Norway

|

USD/NOK | Crude oils |

|

Sweden

|

USD/SEK | Metals and forest products |

|

South Africa

|

USD/ZAR | Precious metals |

|

Russia

|

USD/RUB | Crude oil, natural gas and metals |

How to make use of information to help trade stock on Forex Market News

Trading in stocks using news (Forex Market News) releases is an approach used by many long-term investors and trading short-term. If a company can maintain strong balance accounts, cash flows, and earnings reports regularly, traders may choose to purchase and keep the shares for a greater time.

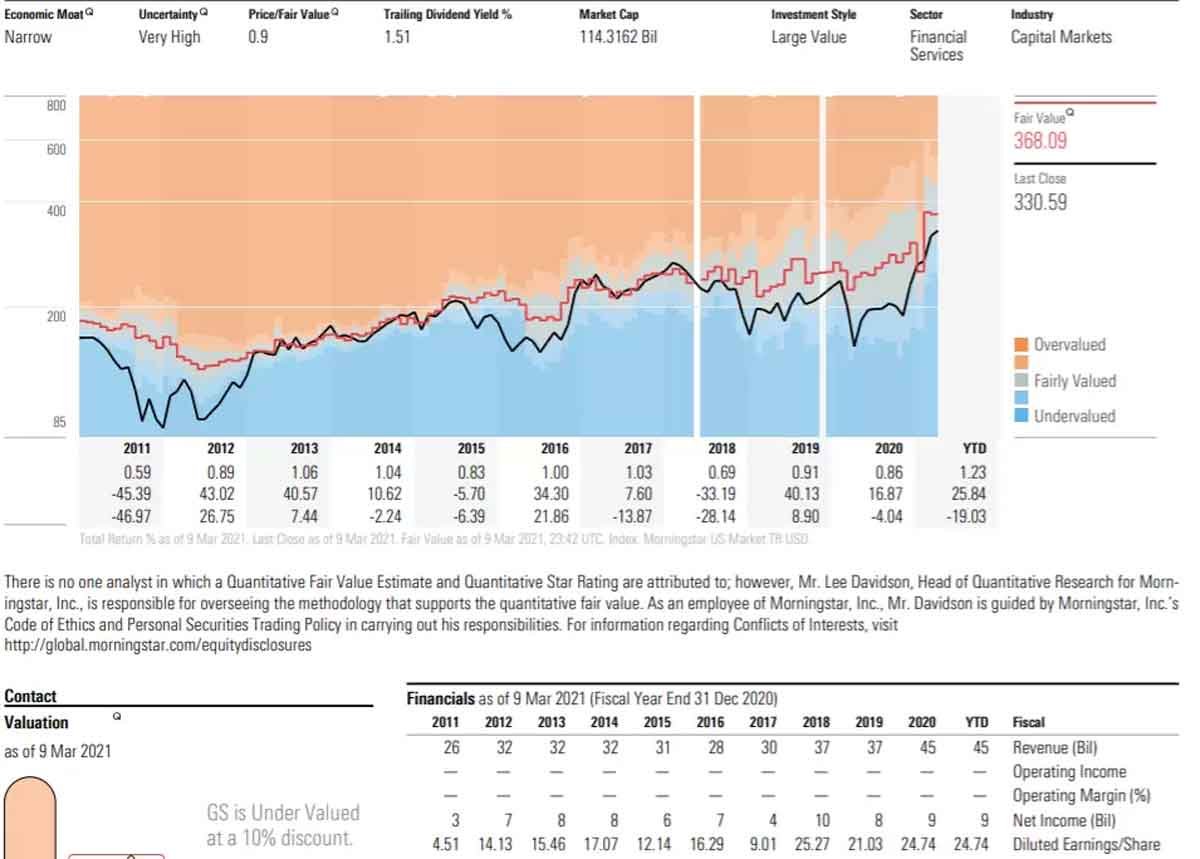

Suppose a company announces a financial report that shows lower numbers than anticipated. In that case, it could trigger an increase in the number of traders who take a position on the stock as its value decreases. Investors should analyze the company before deciding whether or not to invest in a particular stock.

This involves looking at the potential growth rate of the stock in addition to any possible legal, political, or insolvency risk. Financial ratios, such as dividend yields, price/earnings, and dividend ratios, could also tell you if an investment is a sound investment at the moment.

The Morningstar Equity Research reports are regularly updated with information on the company’s fundamentals. They are available for a large range of shares that we offer and provide information on whether they are deemed overvalued, reasonably valued, or undervalued by the market for stocks. The information can assist traders in deciding whether to take an investment or not. Sign up for an account today to gain access to reports from Morningstar. Morningstar reports.

In general, news (Forex Market News) that has significant effects on individual shares of a company could not significantly impact the currency. Market news that has minimal or no impact on currencies is earnings reports, management updates, mergers and acquisitions, and partnerships. This means it could be easier for some people to create more reliable forex news trading predictions about how the market will behave.

Forex Market News trading signals

Certain brokers provide automatic Forex Market News trade signals that aid traders to decide which trade to take, whether to exit, or just avoid trading. These signals are based on the price changes in response to a specific news (Forex Market News) release and may cause traders to decide whether to buy the asset or trade it.

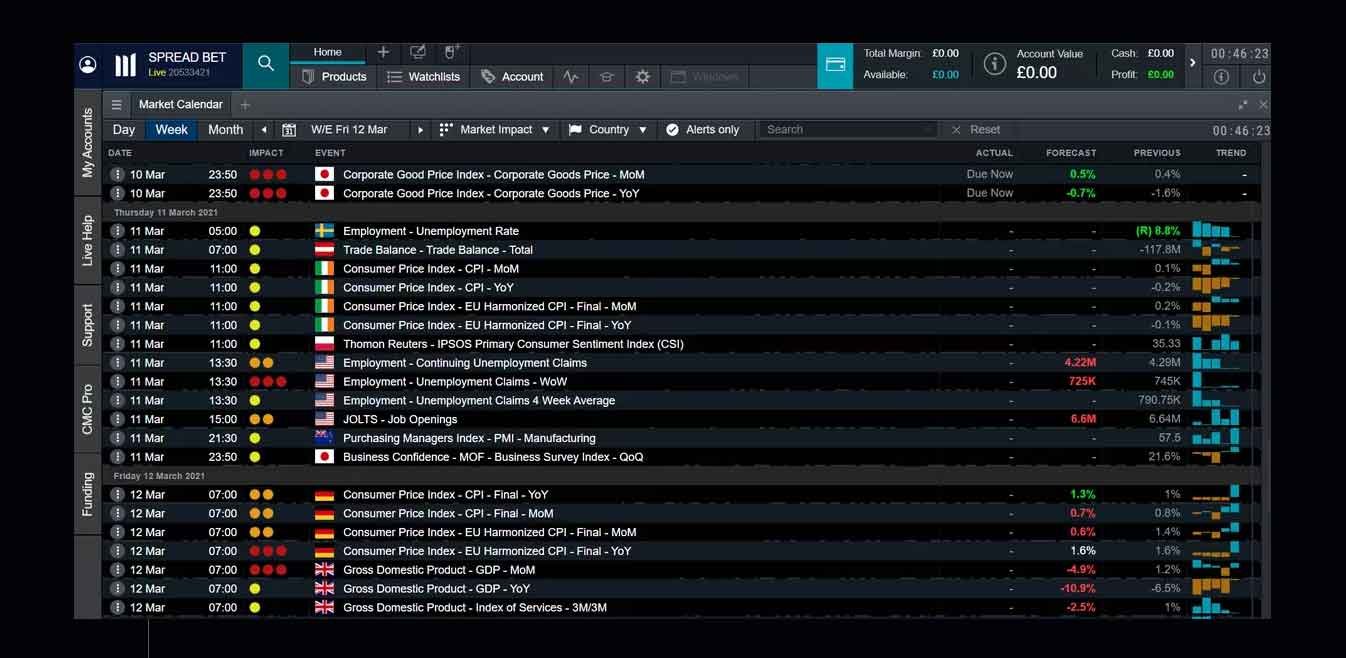

Another option is to keep track of upcoming tradable events using the economy calendar. This feature is available in the Next Generation platform and highlights the latest events, including unemployment figures, GDP, and CPI, as well as PPI figures and survey of sentiment and trade reports. These can impact Forex Market News sentiment and cause significant price fluctuations in the financial markets.

Our market calendar is customized by date and impact on the market (low from high) and the country of origin, which allows you to sort them to make them more relevant for the market or asset you’re looking to trade. You can set alerts for any particular occasions you would like to track.

News releases on trading: what are the advantages of Forex Market News?

It could help boost volatility.

Certain announcements from the financial world could create more volatility to the market, even only for a brief period.

Even the most sophisticated patterns on stock charts or Forex may be temporarily out of synchronization by major announcements in the trading industry, for instance, the latest employment news (Forex Market News) or changes in the rate of interest or inflation by an all-encompassing bank.

Knowing when trading announcements are due could result in making a well-planned trade before the event is major and causes you to trigger your limit loss. It is possible to put off opening new positions until the news (Forex Market News) events have occurred and check whether the reason behind trading is still valid.

It may create unanticipated market reactions.

There is generally an agreement among top economists regarding how any economic report is most likely to arrive at. Modifications related to non-farm employment and GDP or inflation statistics will affect the markets.

For instance, a low level of unemployment indicates a healthy economy, which is why many anticipate that the stock market will climb. The decision to reduce interest rates can affect a country’s currency, making it less appealing, which could cause it to decline against the currencies of other nations.

Sometimes, However, announcements about economics differ from what the market was anticipating, resulting in an opposite reaction in the market. For instance, when central banks hint that rate cuts are short, but the dollar continues to rise, there could be other reasons and the possibility of rate cuts.

This could give a clear “buy” signal. If the currency doesn’t fall due to the expectation of a decrease in interest rates, then the positive sentiment is high and could signal that it’s a ‘buyer’s market.

It could be a sign that trends are shifting.

Many traders are trying to find trends to make earning profits. The underlying trends may span hours, days, or even months. But the majority of trends will reverse at some point. An alteration in fundamental economics may be the first indication of this.

Each journey begins by taking a single step, which is true for trend reverses. A news (Forex Market News) announcement on the economy isn’t usually enough to change the course of the direction of a trend in the medium term, but the way markets react to shocks can indicate that the mood is beginning to change. This gives traders the chance to make positions available in the early stages of an emerging trend.

The risks of trading in news (Forex Market News)

Naturally, there are disadvantages to news-based (Forex Market News) trading also. Particularly news trading, you will require analytical skills as you’ll need to know how economic announcements impact your trading positions and the overall financial market (Forex Market News) .

There’s also the chance of holding positions for long periods. If the news (Forex Market News) release takes some time or even weeks to be realized, trading positions could be open for a few days. This can result in a risk for overnight trading and can necessitate you to pay for additional charges for holding. So, traders must be sure that they have enough funds in their accounts to cover these expenses.

How do I get started trading? Forex Market News

Create the login through CMC Markets to access our array of analysis and news tools (Forex Market News tools) . It is important to stay current in the constantly evolving financial markets(Forex Market News). You may trade on news (Forex Market News) reports using either CFD or spread betting accounts. Read our post on the differences between spread betting and CFDs to begin.

Software for Forex Market News

As we’ve mentioned as well, as mentioned, our trader platform online, Next Generation, regularly publishes reports and news (Forex Market News) articles on all markets. We also provide analyses from Morningstar and market updates and commentaries from Reuters, information on Our news section, and insight on the platform.

If you follow our Forex Market News, it ensures that you’re up-to-date on the most recent trends and developments within the financial market, in addition to more general announcements about economics.

This award-winning software is now available for tablet and mobile devices, including iOS and Android platforms.

With all of the standard charting functions, These mobile apps let you trade and keep track of news (Forex Market News) updates on the go. It is also possible to create trading alerts on both mobile and desktop and select to receive notifications on the app, SMS, or email. Learn more details about alerts for trading.

*No1 Web-Based Platform ForexProNews.com Awards in 2020. Best Phone and Best Email Customers Service based on the most satisfied customers among spread betters, CFD & FX traders, Investment Trends 2020 Leverage Trading in the UK Report; Best Platform Features and Best Mobile/Tablet Application and The Investment Trends 2018 UK Leverage Report.

Disclaimer: CMC Markets is an execution-only service provider. The content (whether and contains any views) is intended for general informational purposes only and does NOT reflect your specific situation or goals. This material does not constitute (or is meant to constitute) financial or investment advice upon which any reliance is placed.

The opinions expressed in the content constitute a suggestion by CMC Markets or the author that any specific investment transaction, security, or strategy for investing is appropriate for any particular person.

The information has not been made in conformity with regulations designed to enhance the impartiality of investment research. Although we are not prohibited from dealing with the material, we are not seeking to gain from the information before its release.