-

GBP/USD consolidates its recent losses to the weekly low amid a bullish US Dollar.

-

Reviving bets for one more Fed rate hike and a softer risk tone underpin the buck.

-

Expectations that the BoE will start cutting rates in 2024 weigh on the British Pound.

-

The downside remains cushioned as traders await the release of the UK Q3 GDP print.

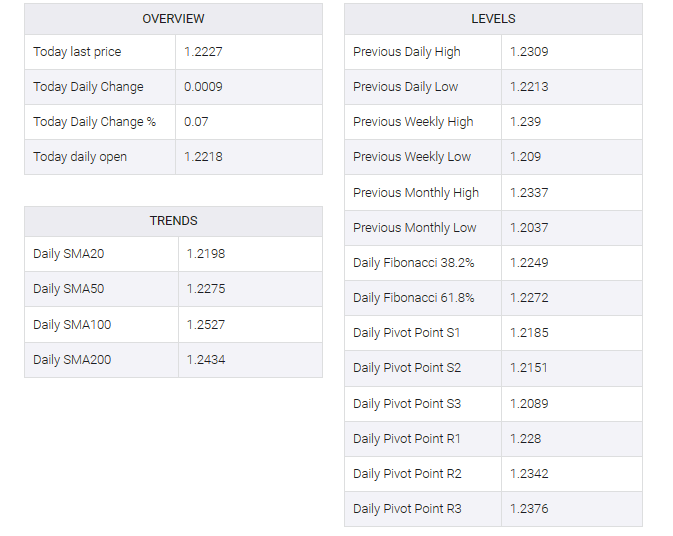

The GBP/USD pair entered a bearish consolidation phase on Friday and oscillated in a narrow band around the 1.2220-1.2225 area, above a one-week low touched during the Asian session.

The US Dollar (USD) managed to preserve overnight gains inspired by Federal Reserve (Fed) Chair Jerome Powell’s comments and served as a major factor for the GBP/USD pair. Speaking at an International Monetary Fund event, Powell said he was not confident they had “achieved a monetary policy stance that is sufficiently restrictive to bring inflation down to 2 percent over time.

This comes on the back of recent dovish comments from several Fed officials and raised expectations that the US central bank may tighten its monetary policy further. In addition, a weak auction of 30-year Treasury bonds pushed yields higher across all maturities and underpinned the buck. Apart from this, a generally weak tone around equity markets is seen as another factor benefiting the safe-haven greenback.

The British Pound (GBP), on the other hand, strengthened due to a gloomy outlook for the UK economy and hopes that the Bank of England (BoE) will start cutting interest rates soon. Indeed, the BoE’s chief economist Huw Pill said earlier this week that the risk of too much of a slow hike was high and added that current market pricing for the first rate cut in August 2024 did not seem entirely unreasonable.

The downside for the GBP/USD pair, however, remains as traders prefer to wait for the release of the preliminary UK Q3 GDP report before placing new directional bets. Against the aforementioned bearish fundamental backdrop, even a slight disappointment from the UK GDP print would be enough to trigger fresh selling around the GBP/USD pair and pave the way for an extension of the weekly downtrend.

Later during the early North American session, traders will take cues from the release of the Michigan Consumer Sentiment Index. This, along with the US bond yields and the broader risk sentiment, will influence the USD price dynamics and produce short-term trading opportunities around the GBP/USD pair. Nevertheless, spot prices remain on track to register weekly losses and seem vulnerable to slide further.