-

GBP/USD attracts some buyers for the second straight day and draws support from a softer USD.

-

A fresh leg down in the US bond yields, along with a positive risk tone, undermines the Greenback.

-

Spot prices react little to the UK jobs data as the focus remains glued to the crucial US CPI report.

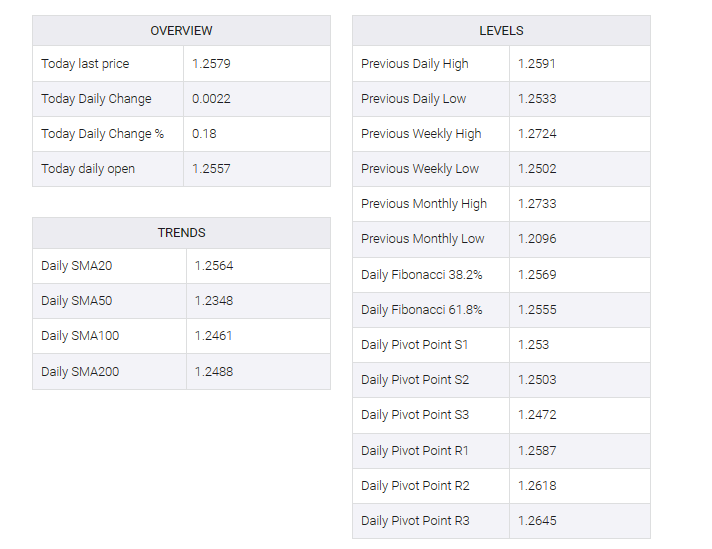

The GBP/USD pair gained some positive traction for a second day on Tuesday, though struggled to capitalize on the move and remained below overnight swing highs. Spot prices moved slightly after the release of UK monthly jobs data and settled near the 1.2580-1.2585 region, up 0.25% for the day.

The UK Office for National Statistics (ONS) reported that the number of people claiming unemployment-related benefits rose to 16K in November, compared to expectations of 20.3K. Adding to this, the previous month’s reading was also revised to 8.9K from the originally reported 17.8K. However, this was overshadowed by a bigger-than-expected drop in average earnings in the three months to October. This comes amid growing bets that the Bank of England’s (BoE) rate-hiking cycle could be reversed in 2024 and serves as a key factor for the British pound (GBP).

The US dollar (USD), on the other hand, is ticking a fresh leg lower on US Treasury bond yields and bets that the Federal Reserve (Fed) will not raise interest rates again. In addition, a generally positive tone around equity markets undermined the greenback’s relative safe-haven status amid some restorative trade ahead of the latest US consumer inflation figures, due for release later today. This, in turn, supports the bid tone around the GBP/USD pair, although traders prefer to wait on the sidelines before a key central bank risk event.

The Fed is scheduled to announce its policy decision on Wednesday after a two-day meeting. This will be followed by the BoE meeting on Thursday, which will play a key role in influencing the GBP and provide some meaningful impetus to the GBP/USD pair. Meanwhile, a recent bounce from the 1.2500 psychological mark or an extension from last Friday’s monthly low calls for some caution in the aforementioned fundamentals.