-

GBP/USD recovers its intraday losses on the weaker US Dollar.

-

The risk-on mood fades on escalated tension in the Middle East.

-

Barclays revised its forecast on the Fed rate cut to March from June.

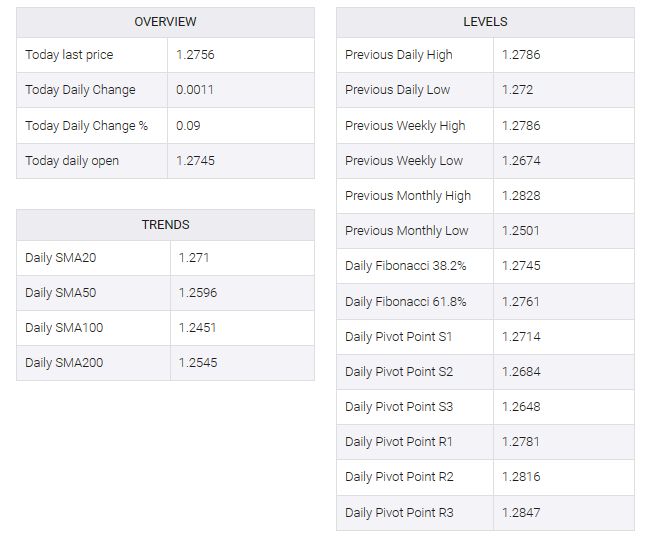

GBP/USD dipped near 1.2760 during the European session on Monday, with the US dollar (USD) recovering intraday losses as it lost ground on weak US bond yields combined with soft producer price index (PPI) data from the United States (US). Rising tensions in the Middle East have weighed on the sense of risk, especially after Friday’s military strikes on Iran-led Houthi targets led by the United States (US) and the United Kingdom (UK). These geopolitical developments have affected both the strength of the US Dollar and the overall sentiment of the GBP/USD pair.

The US Dollar Index (DXY) pared its intraday gains as US Treasury yields fell. The 2-year and 10-year yields on US bond coupons were down 4.14% and 3.94%, respectively, as of press time. Increased market speculation about a possible rate cut by the US Federal Reserve (Fed) in March has put pressure on US yields. The speculation gained momentum, especially after Barclays revised its forecast for the first Federal Reserve rate cut on Friday, moving it forward from June to March.

Moreover, the expected price index (PPI) data released on Friday could put downward pressure on the US dollar. According to the US Bureau of Labor Statistics, the producer price index (PPI) figure for December was 1.0% annualized, compared to the previous reading of 0.8%. Core PPI reached 1.8% on the year, down from 2.0% in November. On a monthly basis, both the headline and core PPI indices remained at 0.1% decline and 0.0% respectively.

The GBP/USD pair may gain some ground on improved manufacturing data from the United Kingdom (UK) released on Friday. Activity in the United Kingdom (UK) industrial sector revived in November, according to data from the Office for National Statistics (ONS) released on Friday. Gross industrial production (MoM) was in line with expectations and reversed the previous decline. On an annual basis, UK manufacturing output rose in November. However, total industrial production fell by 0.1% during the same period.

Additionally, on Monday, January’s Rightmove House Price Index (MoM) increased by 1.3% against a previous decline of 1.9%. Whereas the year-on-year decline was 0.7% against a 1.1% decline in December. Traders will likely monitor labor market data, including claims count changes and the ILO unemployment rate (3M).