-

GBP/USD extends its downside around 1.2140 ahead of key events.

-

Federal Open Market Committee (FOMC) is expected to hold the rate unchanged at its November meeting while holding a hawkish stance.

-

Bank of England (BoE) is anticipated to keep rates steady amid the fear of potential recession in the UK.

-

The FOMC and BoE meetings will be in the spotlight ahead of the US Nonfarm Payrolls data.

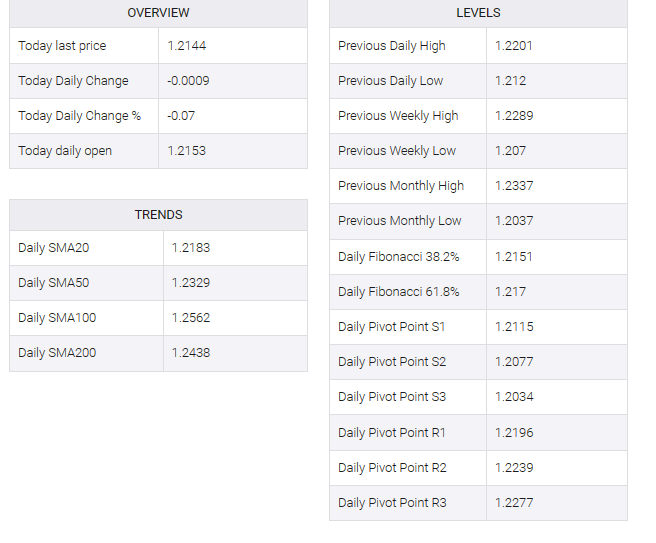

The GBP/USD pair remains on the defensive in the early Asian session on Wednesday. The major pair faces rejection near the 1.2200 mark. Market players await the highly anticipated Federal Open Market Committee (FOMC) policy meeting on Wednesday ahead of the Bank of England (BoE) on Thursday. This event may trigger volatility in the market. GBP/USD is currently trading near 1.2139, having lost 0.11% on the day.

The two-day FOMC policy meeting begins today and ends on Wednesday. Markets expect the FOMC to keep interest rates unchanged at its November meeting. Traders will be watching FOMC Chair Powell’s press conference for fresh stimulus. If the FOMC delivers a hawkish message, the US dollar (USD) may attract some buyers and weigh on the GBP/USD pair.

On the other hand, the Bank of England (BoE) is expected to keep interest rates steady at 5.25% at its November meeting on Thursday amid growing concerns about a slowdown in the UK economy. After the meeting, BoE Governor Andrew Bailey may give some indication of the latest forecast for the UK economy and the future of monetary policy.

Weak UK data and stubborn inflation weighed on the British Pound (GBP) and acted as headwinds for the GBP/USD pair. Additionally, heightened geopolitical risk in the Middle East could boost safe haven flows and benefit the greenback.

Investors will take cues from the US ADP employment report, JOLTS Job Openings, and the ISM Manufacturing PMI ahead of the FOMC meeting on Wednesday. On Thursday, the BoE rate decision and BoE Governor Bailey’s speech will be the highlights. The US employment data, including Nonfarm Payrolls and Average Hourly Earnings for October, will be released on Friday.