-

GBP/USD holds positive ground around 1.2565 ahead of the key events.

-

Markets believe that the FOMC will not only halt hiking but will also begin cutting rates as soon as March 2024.

-

Market players anticipate the BoE to hold rates unchanged at 5.25% and maintain their higher for a longer narrative.

-

Investors await the UK employment data and US inflation data on Tuesday.

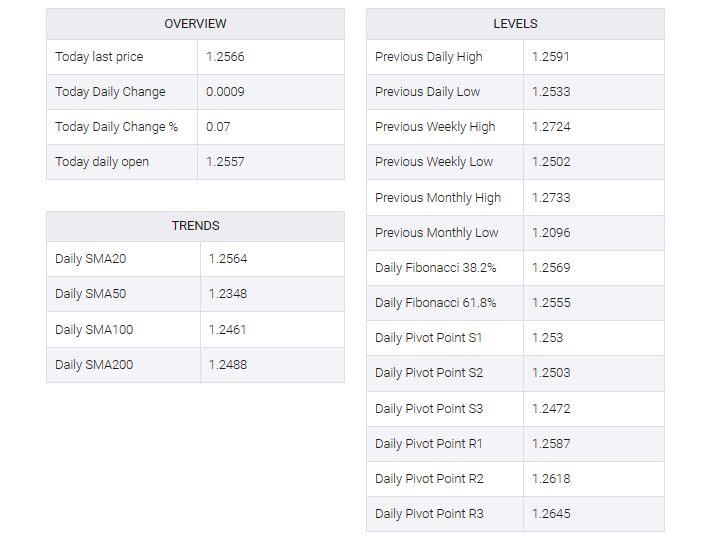

The GBP/USD pair recovers some lost ground during the early Asian trading hours on Tuesday. The highlight this week will be the interest rate decisions of the US Federal Reserve (Fed) and the Bank of England (BoE). The major pair currently trades near 1.2565, gaining 0.07% on the day.

The Federal Open Market Committee (FOMC) begins its two-day meeting on Tuesday and will announce an interest rate decision on Wednesday. Markets had widely expected the FOMC to keep interest rates steady at 5.25-5.50% for a third straight meeting. Markets anticipate that the FOMC will not only stop raising interest rates, but begin cutting rates as soon as March 2024.

Across the pond, market players expect the BoE to keep rates unchanged at 5.25% and maintain them higher for the longer term. However, traders expect the BoE to cut rates next year, but at a slower pace than the central bank Fed and the European Central Bank (ECB).

In a busy week in terms of economic data, market participants will focus on Tuesday’s UK employment data, including the unemployment rate, claimant count changes and wage inflation data. The UK unemployment rate is expected to remain at 4.2% for the three months ending in October.

On the US docket, the US inflation, as measured by the Consumer Price Index (CPI) will be due later on Tuesday. The monthly CPI figure is expected to grow by 0.1% MoM from 0%, and the annual rate is projected to ease from 3.2% YoY to 3.1%. On Wednesday, the US Producer Price Index (PPI) will be released.