-

GBP/USD attracts some sellers to 1.2528 following the downbeat UK data.

-

The UK GDP rate dropped 0.3% in October from 0.2% growth in September.

-

US Consumer Price Index (CPI) data indicated that price increases in November remained moderate.

-

Investors await the US Producer Price Index (PPI) ahead of the Fed interest rate decision.

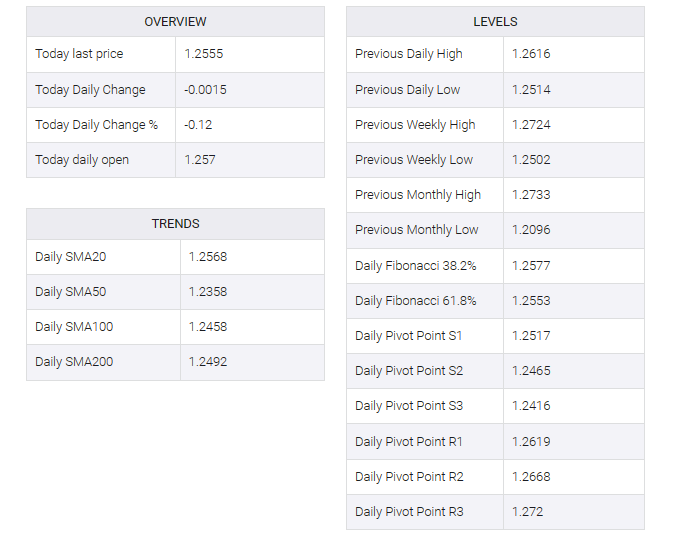

The GBP/USD pair drops sharply below the mid-1.2500s during the early European session on Wednesday. The weaker-than-expected UK GDP growth data and Industrial Production weigh on the British Pound (GBP) and create a headwind to the GBP/USD. At press time, GBP/USD is trading at 1.2528, losing 0.34% for the day.

The latest data from the Office for National Statistics on Wednesday showed that UK monthly gross domestic product (GDP) growth for the three months ended October contracted by 0.3% MoM from a previous reading of 0.2% expansion, below the market consensus of 0.2% growth.

Meanwhile, the country’s industrial production data for October was worse than market expectations, falling 0.8% MoM. Manufacturing production) fell by 1.1% MoM against a 0.1% increase in the previous reading.

The Bank of England (BoE) is expected to keep its interest rate unchanged at 5.25% for the third consecutive meeting on Thursday. Markets expect three rate cuts totaling 100 basis points (bps) next year to 2024. That would bring the rate down to 4.25%, according to ING

The Fed is widely expected to keep borrowing costs steady on Wednesday. Markets expect Fed Chair Jerome Powell to maintain that cautious outlook and push back against the odds of a rate cut. However, Fed funds futures are pricing in an 80% chance of a rate cut in May, according to the CME FedWatch tool.

Tuesday’s release of inflation data indicated that price increases moderated in November. The US Consumer Price Index (CPI) rose 0.1% MoM from the previous reading of 0% and rose 3.1% YoY compared to 3.2% previously in November. Both numbers were in line with market consensus. Additionally, core CPI, which excludes volatile food and energy prices, rose an estimated 0.2% to 0.3% MoM, while annual core CPI rose 4.0% YoY, in line with expectations.

The US Producer Price Index (PPI) for November will be released on Wednesday, which is expected to show an increase of 0.1% MoM and 1.0% YoY, respectively. The PPI ex Food & Energy is estimated to ease from 2.4% to 2.2% YoY. Later on Wednesday, the Fed will announce the interest rate decision at its last meeting of the year, followed by a press conference. On Thursday, the Bank of England (BoE) will announce its decision on monetary policy. These events could give a clear direction to the GBP/USD pair.