-

GBP/USD loses ground on risk aversion as escalation of the Middle East conflict is possible.

-

The Pound Sterling faces challenges before the release of UK labor data on Tuesday.

-

Governor Bailey’s testimony has been canceled; traders will look for his remarks in Davos.

-

Houthis are likely to broaden their targets in the Red Sea region including US vessels.

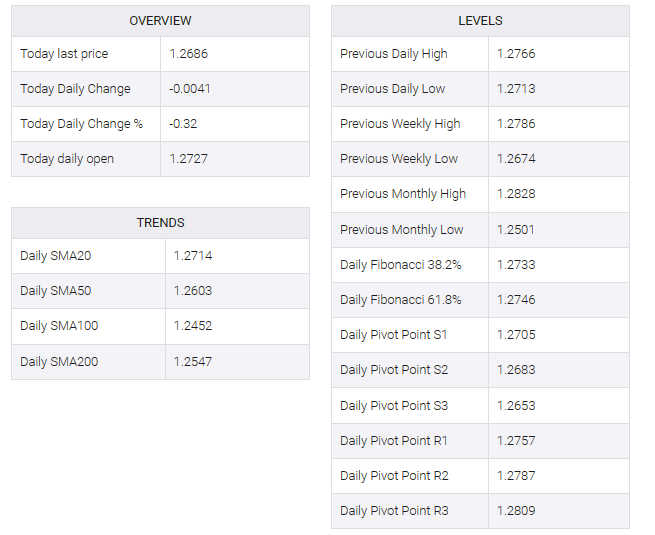

GBP/USD moved closer to 1.2690 in the Asian session on Tuesday. The Pound Sterling (GBP) lost ground against the US Dollar (USD) in risk aversion, which could be attributed to geopolitical risk concerns dominating the sentiment of market participants. Furthermore, traders await labor market data from the UK on Tuesday.

The UK claimant count change came in at 16K in November, while the ILO unemployment rate (3M) is forecast to hold steady at 4.2%. October’s employment change printed 50K figures. Additionally, Tuesday’s Bank of England (BoE) Governor Andrew Bailey’s testimony scheduled before the Lords Economic Affairs Committee in London has been cancelled. Traders will be looking to see if the BoE governor speaks at the World Economic Forum in Davos, Switzerland.

On Monday, an official of Yemen’s Houthi movement announced their intention to expand their targets in the Red Sea region to include US ships. The statement came in response to continued attacks, as Iran-allied groups vowed to continue despite recent US and British strikes in Yemen. A US-owned and operated container ship succumbed to an anti-ship ballistic missile attack from Houthi-controlled territory in Yemen. This event shifted the previously optimistic sentiment to risk aversion, thereby providing support to the US dollar (USD).

Atlanta Federal Reserve (Fed) President Raphael Bostick believes interest rates should remain unchanged at least through the summer to prevent a rebound in prices. Bostick emphasized the risk of inflationary fluctuations if policymakers decide to ease the measures prematurely. He warned that the central bank’s pace toward its 2.0% target is expected to slow in the coming months.