-

GBP/USD remains under selling pressure around 1.2560 on the stronger USD.

-

Analysts anticipate the Fed will hold rates until at least July, later than earlier thought.

-

Bank of England’s Bailey said interest rates in the UK will need to stay at current levels for some time.

-

Investors await the weekly US Jobless Claims for fresh impetus.

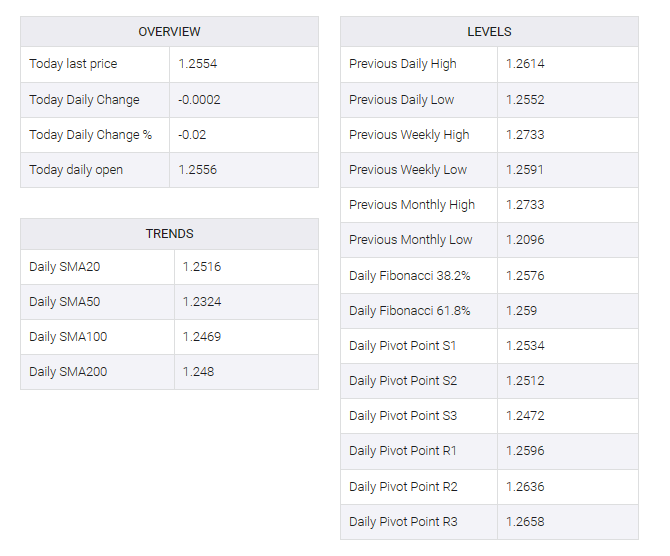

The GBP/USD pair extends its downside above the mid-1.2500s during the early Asian trading hours on Thursday. The downtick of the pair is backed by the firmer US Dollar (USD) broadly. In the absence of economic data released from the UK docket later this week, the GBP/USD pair remains at the mercy of USD price dynamics. At press time, the major pair is trading at 1.2560, gaining 0.03% for the day.

Although US Federal Reserve (Fed) Chair Jerome Powell said last week that central banks would be prepared to tighten policy further if it was appropriate to do so, markets believe the tightening cycle is now over. Analysts expect the Fed to keep interest rates on hold until at least July, later than previously thought, according to a Reuters poll.

About Data, Automatic Data Processing Inc. ADP reported on Wednesday that private payrolls rose 103K in November, below the market consensus of 106K to 130K in October.

On the GBP front, Bank of England (BoE) Governor Andrew Bailey said on Wednesday that interest rates in the UK should remain at current levels for some time and the central bank is aware of financial stability risks that could develop from this.

In addition, Bailey added that the overall risk environment was challenging due to China’s economic difficulties, potential wider conflict in the Middle East and high levels of government debt. This, in turn, could weigh on the British Pound (GBP) and act as a headwind for the GBP/USD pair.

Going forward, traders will watch the weekly US jobless claims, which are due later on Thursday The highlight of the week will be US employment data on Friday, including nonfarm payrolls and the unemployment rate. November nonfarm payrolls are expected to add 185K jobs while the unemployment rate is projected to hold steady at 3.9%.