-

GBP/USD extends the rally to 1.2760 amid the risk-on mood.

-

New York Federal Reserve (Fed) President Williams speaks on the 2024 economic outlook.

-

BoE Governor Andrew Bailey said that he hoped that the recent fall in the cost of mortgages would continue.

-

Traders will closely focus on the December US Consumer Price Index (CPI) on Thursday.

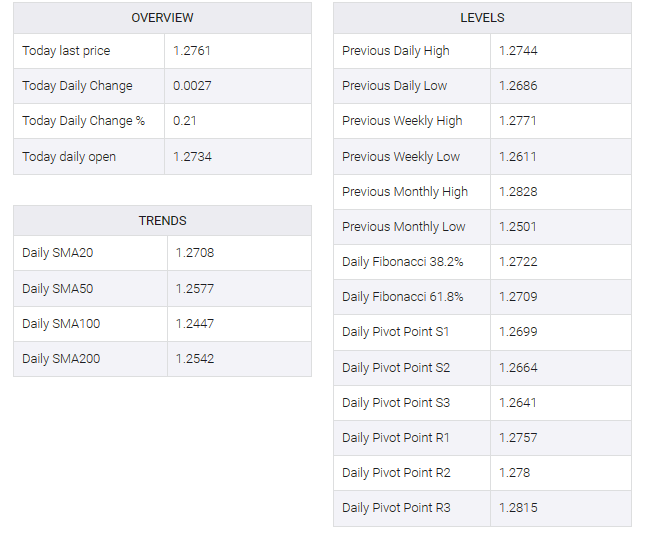

The GBP/USD pair gains momentum above the mid-1.2700s during the early Asian session on Thursday. The US Dollar (USD) weakness and risk-on environment lend some support to the major pair ahead of the key US inflation data, due later on Thursday. GBP/USD currently trades around 1.2760, up 0.21% on the day.

Late Wednesday, New York Federal Reserve (Fed) President Williams spoke about the economic outlook for 2024. Williams said U.S. interest rates will need to remain high “for some time” until central bank authorities are confident inflation will return to the 2% target. According to WIRP, the market has priced in a 5% chance of a rate cut on January 31 and a nearly 70% chance of a rate cut on March 20. This, in turn, could create some selling pressure on the greenback and act as a tailwind for the GBP/USD pair.

Bank of England (BoE) Governor Andrew Bailey said on Wednesday that he expected the recent decline in mortgage costs to continue. However, the BoE governor gave no indication of the path for interest rates, as he confirmed the need to bring down inflation. Meanwhile, Jonathan Hall, an outside member of the BOE’s monetary policy committee, said Wednesday that falling interest rates and recovering growth are among the biggest risks to financial stability this year.

Market players will focus on December US inflation data, as measured by the Consumer Price Index (CPI), later on Thursday. On Friday, UK manufacturing production, industrial production and monthly gross domestic product for November will be released. This statistic can give a clear direction to the GBP/USD pair.