-

GBP/USD trades strongly for the third consecutive day on Friday.

-

The BOE may be forced to provide the timeline of its first rate cut as inflation might decline faster than expected.

-

The US CPI inflation reports may challenge the plans of the Federal Reserve (Fed) to cut the interest rate this year.

-

Traders will monitor the monthly GDP growth numbers for November and the US Producer Price Index (PPI).

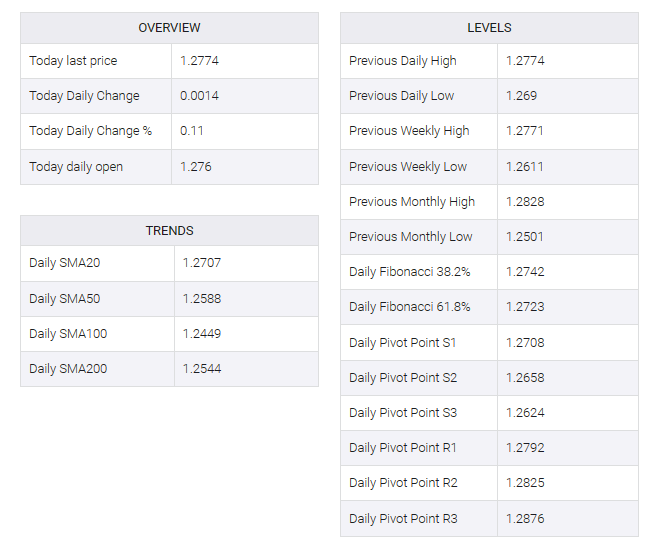

The GBP/USD pair neared weekly highs in early Asian trading hours on Friday. UK Gross Domestic Product (GDP) for November is estimated to have increased by 0.2% MoM, following a contraction of 0.3% in the previous reading. GBP/USD is currently trading near 1.2780, up 0.16% on the day.

Bank of England (BOE) Governor Andrew Bailey predicted an uphill battle to get inflation back to its 2% target and pushed back against speculation about a rate cut. Even so, lower electricity prices could cause inflation to ease at a faster pace than the BOE expects. The UK central bank may be forced to provide a timeline for its first interest rate cut after three leading forecasters issued surprise updates to halve inflation to 2% by April.

On the USD’s front, the recent US inflation reports may challenge the plans of the Federal Reserve (Fed) to cut the interest rate this year. The US Bureau of Labor Statistics showed on Thursday that the US Consumer Price Index (CPI) increased more than estimated in December, as the CPI rose 3.4% YoY from the 3.1% increase seen the month prior. The Core CPI figure, which excludes volatile food and energy prices, grew 3.9% YoY in December, above the market consensus of 3.8%.

Looking ahead, market participants will keep an eye on the UK Manufacturing Production, Industrial Production, and monthly Gross Domestic Product for November. On the US docket, the Producer Price Index (PPI) for December will be due, and Fed’s Neel Kashkari is set to speak.