-

GBP/USD strengthens to 1.2715 amid the USD weakness.

-

BoE’s Haskel said the inflationary pressures remain in the UK labour market and there was no way to cut rates any time soon.

-

US CB Consumer Confidence climbed to 102.00 in November, vs. a downward revision to 99.1 prior.

-

Traders will closely watch the US growth numbers, due later on Wednesday.

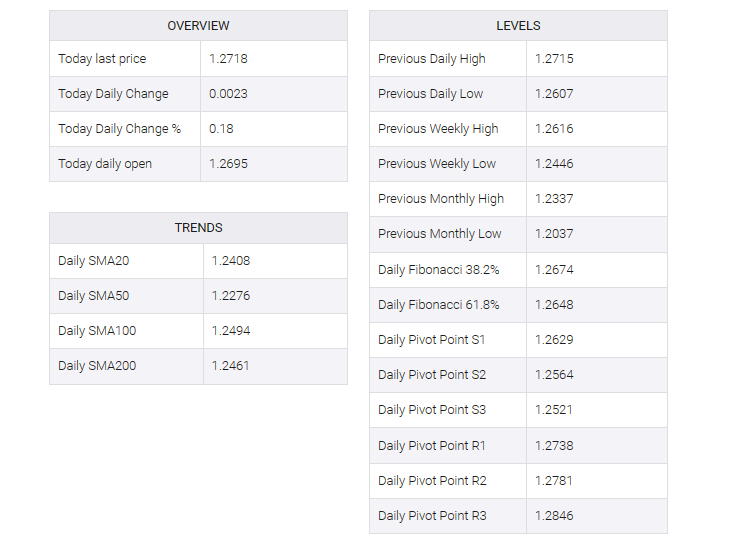

The GBP/USD pair moved above 1.2700 during the early European session on Wednesday. The pair’s gains were supported by a weaker US dollar (USD) and lower US Treasury bond yields. The pair is currently trading near 1.2715, up 0.19% on the day.

The governor of the Bank of England (BoE), Jonathan Haskell, said that inflationary pressures remain in the UK labor market and there is no way to cut interest rates from their 15-year highs any time soon. However, BoE Deputy Governor Dave Ramsden said monetary policy needed to be tighter for a while to reduce inflation. On Monday, BoE Governor Andrew Bailey said that bringing inflation down to the central bank’s 2% target would be difficult because much of its recent decline was caused by a surge in fuel prices last year. Nevertheless, the BoE’s latest forecasts show it expects inflation to return to 2% by the end of 2025.

Federal Reserve (Fed) Governor Christopher Waller said on Tuesday that inflation remains too high for now, but he said progress had been made and the Fed would not need to raise rates from here. That being said, the rising prospects that accompany the Fed’s rate hikes weigh on the USD and act as a tailwind for the GBP/USD pair.

In addition, Tuesday’s data showed that US CB consumer confidence rose to 102.00 in November, compared to a downward revision to 99.1 earlier. Richmond Fed manufacturing fell to 5.0 from a 3.0 increase in the previous reading. The S&P/Case-Shiller home price index rose 3.9% YoY in September, below estimates of 4.0%.

Market participants will be eyeing annual US gross domestic product for the third quarter (Q3) starting Wednesday. Growth is expected to expand to 5.0%. Also, BoE Governor Bailey will speak later in the day. Traders will take cues from this data and find trading opportunities around the GBP/USD pair.