-

GBP/USD trades with a mild positive bias on Tuesday amid subdued USD price action.

-

Fed rate cut bets trigger a fresh leg down in the US bond yields and undermine the USD.

-

A softer risk tone helps limit losses for the safe-haven buck and keeps a lid on the pair.

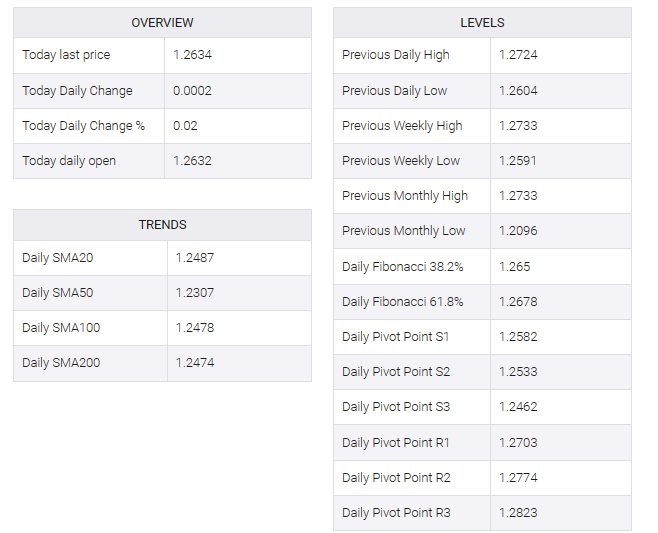

The GBP/USD pair edges higher during the Asian session on Tuesday and looks to build on the overnight bounce from the 1.2600 mark, representing the lower boundary of a one-week-old trading range. Spot prices currently hover around the 1.2630-1.2635 region and draw support from a combination of factors.

The US dollar (USD) struggled to capitalize on the previous day’s strong move for more than a week amid expectations that the Federal Reserve (Fed) will not raise interest rates again and may start easing its policy as early as March 2024. This triggered a new leg in US Treasury bond yields and put USD bulls on the defensive, which is seen as a key factor acting as a tailwind for the GBP/USD pair.

The British Pound (GBP), on the other hand, has been impacted by the easing of odds for an initial rate cut by the Bank of England (BoE). Indeed, BoE Governor Andrew Bailey recently warned that it was too early to declare victory against inflation and predicted that monetary policy would need to be restrained for some time to ensure that inflation returns to the 2% target. This further contributed to the rise of the GBP/USD pair.

That said, a softer risk tone is seen to lend some support to the safe-haven greenback and deter traders from placing aggressive directional bets. Investors also seem reluctant and prefer to wait on the sidelines ahead of this week’s key US macro data, starting with the release of the ISM services PMI later in the first North American session. However, the focus will remain on Friday’s key US NFP report.

Nevertheless, the aforementioned fundamental backdrop seems to be leaning in favor of bullish traders and suggests that the path of least resistance for the GBP/USD pair is to the upside. However, it would still be prudent to wait for a sustained move beyond the 1.2725-1.2730 supply zone, or the top end of the short-term trading range, before positioning for a more appreciative move ahead of the final UK Services PMI print.