-

GBP/USD ticks higher during the Asian session on Tuesday, albeit lacks follow-through.

-

Retreating US bond yields, a positive risk tone undermines the USD and lends support.

-

Expectations that the BoE is done hiking rates keep a lid on further gains for the major.

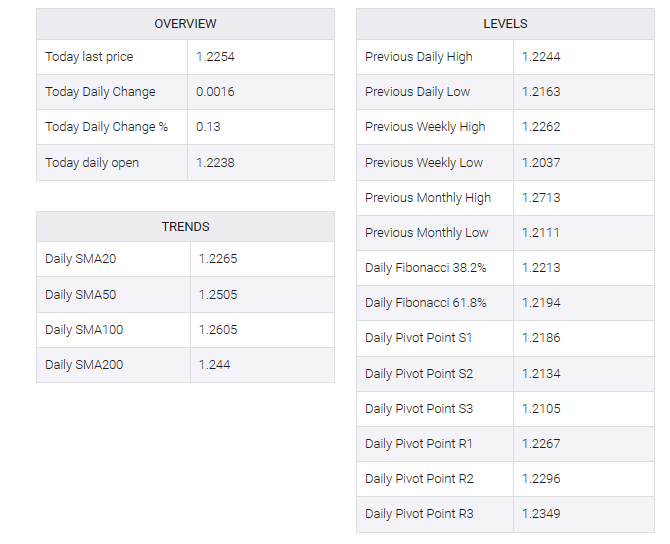

The GBP/USD pair built on the previous day’s goodish rebound above 80 pips from the 1.2165-1.2160 area and extended its steady climb through the Asian session on Tuesday. The spot price, however, lacks bullish conviction, warranting some caution before positioning for an extension of the recent recovery move from mid-March lows near the 1.2035 area touched last week.

A combination of factors dragged the US dollar (USD) to a one-and-a-half-week low, which appeared to act as a tailwind for the GBP/USD pair. US wage growth data released on Friday eased relatively subdued inflation concerns and may allow the Federal Reserve (Fed) to soften its hawkish stance. Moreover, Fed officials struck a cautious tone about the need for further rate hikes and cut US Treasury bond yields further.

Meanwhile, the initial reaction to the military conflict between Israel and the Palestinian Islamist group Hamas appeared to be short-lived given the slight ambivalent shift in Fed officials’ outlook. This is clear from a general positive tone around equity markets and further weakens the safe haven. That said, expectations that the Bank of England (BoE) will hold steady in November should be bullish for the GBP/USD pair.

Indeed, the UK central bank surprisingly paused its rate-hiking cycle in early September and gave little indication of its intention to raise rates. As a result, it is wise to wait for a strong follow-through buy before confirming that the GBP/USD pair has formed a near-term bottom and position for any meaningful appreciative move. Going forward, there is no relevant market-moving economic data to be released from the UK or the US on Tuesday.

Later during the North American session, traders will take cues from speeches by influential FOMC members. In addition to this, US bond yields and broader risk sentiment may affect USD price dynamics, allowing traders to seize short-term opportunities around the GBP/USD pair. However, the focus will be on the FOMC minutes and US consumer inflation figures, due out on Wednesday and Thursday respectively.