-

GBP/USD retraces its recent losses as the US Dollar seems to lose ground.

-

The Greenback failed to stay in the positive territory on downbeat US bond yields.

-

Softer US data reinforces the bets on the dovish Fed outlook on interest rate trajectory.

-

Pound Sterling cheers on the expectation of the BoE to maintain a restrictive stance.

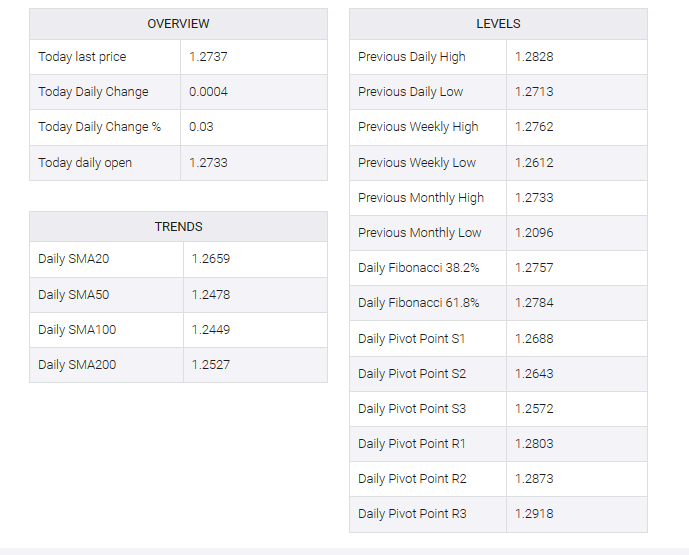

GBP/USD attempts to recover its losses registered in the previous session. The GBP/USD pair trades slightly higher around 1.2740 during the Asian hours on Friday. The US Dollar (USD) attempted to halt its losing streak before the end of the year 2023, but it appears to be struggling to stay in positive territory. The US Dollar Index (DXY) trades lower around 101.10 at the time of writing.

United States (US) Treasuries experienced a downward movement after posting gains in Thursday’s session. This development is notable because it depends on the greenback, with investors predicting an interest rate cut soon. The 2-year and 10-year yields closed higher at 4.28% and 3.84% respectively in the previous session. However, on Friday, both yields stood lower at 4.27% and 3.83% respectively by press time.

Additionally, subdued US economic data, including a larger-than-expected rise in initial jobless claims and flat pending home sales for November, could limit the greenback’s advance. The data reinforces the possibility of the US Federal Reserve (Fed) taking a more accommodative stance in its initial monetary policy decision at upcoming meetings.

US initial jobless claims rose to 218K for the week ended Dec. 23, beating market expectations of 210K. Pending home sales (MoM) came in flat at 0.0% in November against expectations of 1.0%.

The Chicago Purchasing Managers’ Index for December will be an additional data point to watch on Friday, providing further insight into the economic conditions in the Chicago area and contributing to the overall assessment of the US economy.

The pound sterling (GBP) appears to have recovered, driven by market expectations that the Bank of England (BoE) may maintain an accommodative monetary policy stance. In the United Kingdom (UK), inflation is currently the highest among other Group of Seven economies.

However, the decision-making process is challenging for BoE policymakers, as they face the dilemma of dealing with higher price pressures while navigating the risk of the economy entering a technical recession due to rising demand in the domestic market. These complex economic dynamics contribute to currency market volatility and uncertainty, which affects the performance of the British Pound (GBP).

Market participants will likely watch seasonally adjusted UK Nationwide Housing Prices data for December. The month-over-month report is expected to show a flat reading of 0.0% compared to November’s 0.2% increase. While yearly figures could print a 1.4% decline compared to the previous decline of 2.0%.