-

The Pound remains vulnerable, capped below 1.2610.

-

Weak US macroeconomic data are cushioning sterling’s reversal.

-

GBP/USD might trigger a double-top pattern below 1.2600.

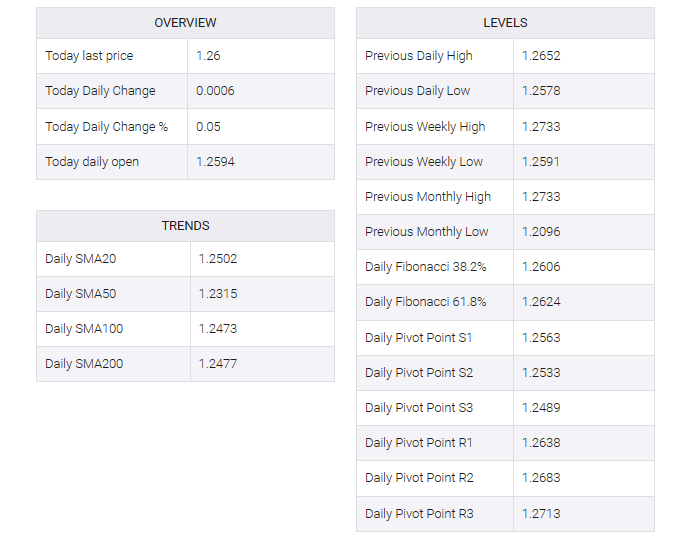

Sterling’s recovery attempt from Tuesday’s low at 1.2575 has been capped at 1.2610 earlier on Wednesday, which has left the pair in noman;’s land awaiting the release of the US ADP employment report.

Weak Construction data adds pressure on the Pound

Earlier today, the UK S&P Global/CIPS Construction PMI declined to 45.6, against expectations of an improvement to 46.3 from the 45.6 reading in October, which has weighed on demand for the GBP.

On the other hand, weak US JOLT data seen on Tuesday added evidence that higher interest rates are starting to pinch the labor market. The Fed expects that the Fed may begin to scale back its tightening cycle early next year, which is hurting the USD.

Against this backdrop, the pair remains steady, with investors awaiting the release of US ADP data and Friday’s US Nonfarm Payrolls for further insight into the Federal Reserve’s monetary policy outlook.

From a broader perspective, technical indicators show that the pair has lost momentum Price action has breached the 4h 50 SMA and is testing a key support at 1.2600. A confirmation below here would trigger a double-top at 1.2730 with rising pressure towards 1.2517 ahead of a measured target at 1.2460.