-

GBP/USD hits a new low on Friday after a week of rough downside action.

-

Next week sees back-to-back central bank appearances from the Fed and BoE.

-

Downside momentum remains a key risk for the GBP heading into the year’s final CB rate calls.

GBP/USD tries to hold 1.2550 after Friday’s market close to a new low for the week near the 1.2500 handle A better-than-expected US nonfarm payrolls (NFP) gave the US dollar (USD) one of the last shocks across the board to round out the trading week. .

The pound sterling (GBP) spent most of the week underwater, waffling against its high-profile peers and seeing only modest gains against its weaker rivals. The GBP/USD pair is down a third from Monday’s opening bid as US economic releases dominate the data docket this week.

Market reaction this week centered on the Federal Reserve’s (Fed) positioning, with investors weighing the increased odds of a Fed rate cut next time rather than on a case-by-case basis, with markets moving in and out of risk bids from one release to the next as US economic data miss or miss. data forecast.

US NFP beats the street, thin UK data keeps the GBP pinned

Friday ended on a USD-positive note after US Nonfarm Payrolls beat expectations once again, showing the US added a net 199K new jobs to the already-tight labor market, above the market forecast of 180K and climbing above October’s print of 150K payroll additions.

November’s ADP Employment Change released earlier in the week showed a below-expectation performance, with ADP reporting a slower pace of new payroll employees of 103K compared to October’s 106K and missing median market forecasts of 130K. The ADP pullback set up over-eager market participants for disappointment with investors leaning heavier into Fed rate cut bets on the back of softening pre-NFP labor data, but Friday’s employment beat muddied the rate expectations waters to wrap up the trading week.

Next week sees a slew of central bank action through the midweek, with the US Fed giving one last rate call for 2023 and updating their inflation outlook dot plot, to be followed by the Bank of England (BoE) and its latest interest rate decision. Both central banks are expected to keep interest rates steady to close out 2023, at 5.5% and 5.25% respectively.

Before central bank action gets underway, next Tuesday brings UK Average Earnings and Claimant Count Change figures; annualized quarterly average earnings are expected to decline from 7.7% to 7.4% in the third quarter, while November is expected to show a slight increase in the number of unemployment benefits seekers from 17.8K to 20.3K.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.16% | 1.25% | 0.76% | 1.55% | -1.01% | 1.42% | 1.42% | |

| EUR | -1.18% | 0.10% | -0.40% | 0.39% | -2.22% | 0.28% | 0.26% | |

| GBP | -1.29% | -0.10% | -0.50% | 0.28% | -2.30% | 0.17% | 0.17% | |

| CAD | -0.76% | 0.41% | 0.51% | 0.80% | -1.79% | 0.68% | 0.67% | |

| AUD | -1.56% | -0.40% | -0.29% | -0.80% | -2.61% | -0.11% | -0.12% | |

| JPY | 0.95% | 2.15% | 2.40% | 1.77% | 2.55% | 2.42% | 2.40% | |

| NZD | -1.44% | -0.27% | -0.17% | -0.68% | 0.11% | -2.47% | 0.00% | |

| CHF | -1.46% | -0.26% | -0.17% | -0.67% | 0.11% | -2.46% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

GBP/USD Technical Outlook

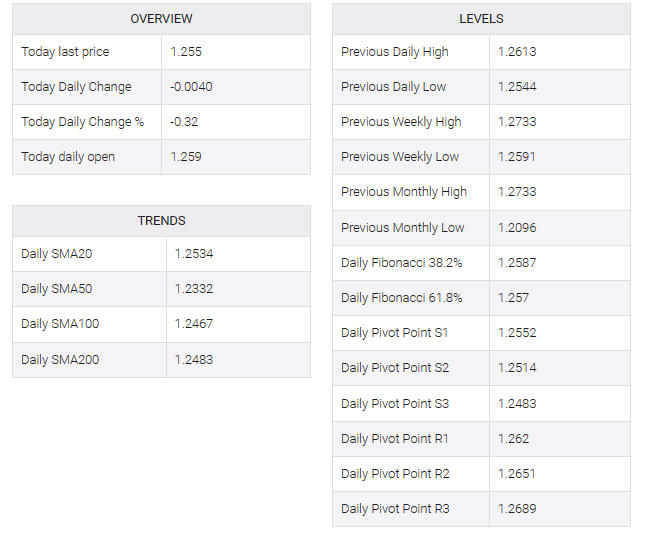

Pound sterling has broken the 200-hour simple moving average (SMA) earlier in the week, falling below the 1.2600 handle to limit the downside for the rest of the trading week. GBP/USD pressed to a new weekly low near 1.2500 on Friday, and the market struggled to hold 1.2550 below the 50-hour SMA.

GBP/USD fell 1.75% peak-to-trough on the week, and is still down 1.33% despite a soft rebound from Friday’s new low, although GBP bulls will note that daily candlesticks are seeing technical support from the 200-day SMA rise to the 1.2500 handle, 50 -With intraday SMA moving upwards from 1.2300.

Despite the week’s decline GBP/USD is still 4.3% above the early October low of 1.2037 and the challenge for bullish bidders will be to see a technical recovery on last week’s high bids and project the pair beyond the 1.2700 handle.