-

GBP/USD remains calm due to lowered inflation from the United Kingdom.

-

UK CPI and Core CPI YoY eased at 3.9% and 5.1%, respectively.

-

Several Fed officials have denied speculations on the Fed’s rate cuts and called it premature.

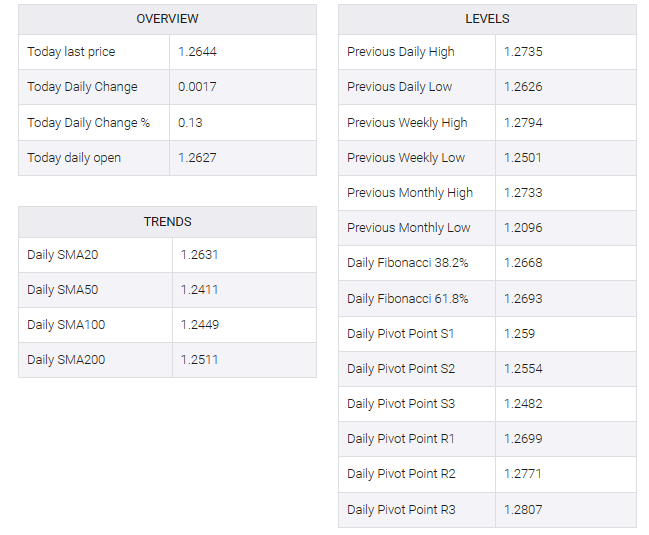

GBP/USD hovered around 1.2640 during Asian hours on Thursday, trying to recover recent losses registered on Wednesday. The Pound Sterling (GBP) faces a challenge due to lower inflation than the United Kingdom (UK). Additionally, the US dollar (USD) witnessed gains on improved economic data from the United States (US).

The UK Consumer Price Index (CPI) (YoY) fell to 3.9% from the previous figure of 4.6%, against an expected reading of 4.4% in November. CPI (MoM) fell 0.2% MoM in November from the previous reading of flat 0.0% and below estimates of 0.1%. Core CPI (YoY) rose to 5.1% vs. 5.7% previously and market consensus of 5.6%. Investors will monitor gross domestic product and retail sales data scheduled for release on Friday.

The US Dollar Index (DXY) experienced a decline, settling near 102.30, despite higher US Treasury yields. At the time of writing the 2-year and 10-year yields on US bond coupons are 4.36% and 3.86% respectively. Speculation surrounding the US Federal Reserve’s (Fed) interest rate trajectory through early 2024 is being reflected by dovish sentiment, contributing to downward pressure on the greenback.

However, it is crucial that several Fed officials emphasize a cautious outlook and discourage premature speculation about lowering policy rates. The dynamic interplay between interest rates, central bank sentiment and market expectations continues to shape the movement of the US dollar.

US existing home sales changes indicated a significant monthly rate increase of 0.8% in November, representing a significant rebound from the previous decline of 4.1%. Adding to the positive economic indicators, CB Consumer Confidence rose significantly in December, marking the most significant increase since early 2021, rising from 101.0 to 110.07.

Looking ahead, market participants are likely awaiting key economic releases on Thursday for further insights into the US economy. These include US Gross Domestic Product Annualized (Q3), Initial Jobless Claims, and the Philadelphia Fed Manufacturing Survey.