-

GBP/USD reverses an Asian session dip to sub-1.2200 levels, albeit lacks any follow-through buying.

-

Escalating geopolitical tension in the Middle East and hawkish Fed expectations underpin the USD.

-

Expectations that the BoE is done hiking rates hold back the GBP bulls from placing aggressive bets.

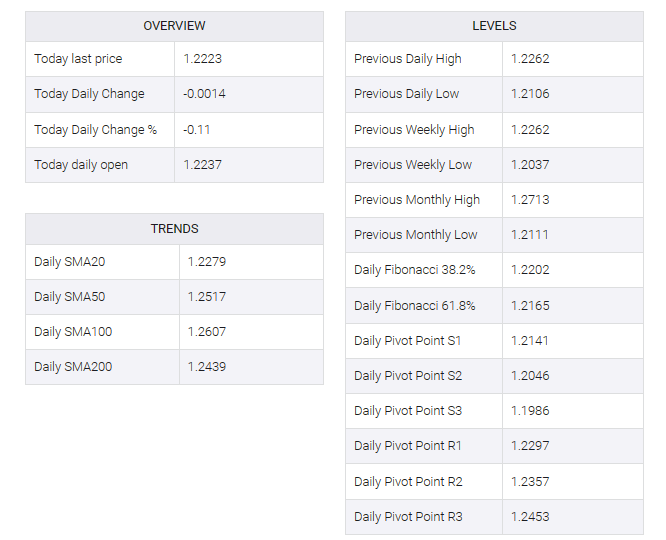

The GBP/USD pair attracted some deep-buying after opening a moderately bearish gap at the sub-1.2200 level on the first day of the new week and returned close to the one-week highs touched on Friday. The spot price currently trades around the 1.2220-1.2225 area and is at the mercy of US Dollar (USD) price dynamics.

Safe haven bucks got a minor lift amid a global flight to safety amid rising geopolitical tensions in the Middle East. The Hamas militant group in the Palestinian Gaza Strip attacked Israeli cities on Saturday in an unprecedented move. In response, Israel launched airstrikes in Gaza and declared war on the Palestinian enclave of Gaza on Sunday, causing hundreds of casualties on both sides. That said, uncertainty over the Federal Reserve’s (Fed) future rate-hike path deterred US dollar bulls from aggressive betting and provided some support to the GBP/USD pair.

Closely watched US monthly jobs data (NFP) released on Friday showed the economy added 336K jobs in September, beating market estimates and an upwardly revised reading of 227K the previous month. The data reaffirmed bets for at least one more Fed rate hike by the end of the year, supporting higher US Treasury bond yields and underpinning the USD. Additional details of the report revealed that wage growth was moderate in the month and eased inflationary concerns. This, in turn, could allow the Fed to soften its hawkish stance.

Therefore, investors keep a close eye on this week’s release of Wednesday’s FOMC meeting minutes, which will be followed by the latest US consumer inflation figures on Thursday. This will help investors determine the Fed’s next policy move, which, in turn, will determine the USD trajectory and give the GBP/USD pair a new impetus. Meanwhile, expectations that the Bank of England (BoE) will keep interest rates unchanged again at its next meeting in November could weaken the British pound (GBP) and put a lid on any meaningful upside for spot prices.