-

GBP/USD experienced losses due to US moderate economic data.

-

Investors turn cautious around BoE’s policy decision and the UK’s gloomy economic situation.

-

UK’s FCA stated that British savings account holders can take advantage of higher interest rates.

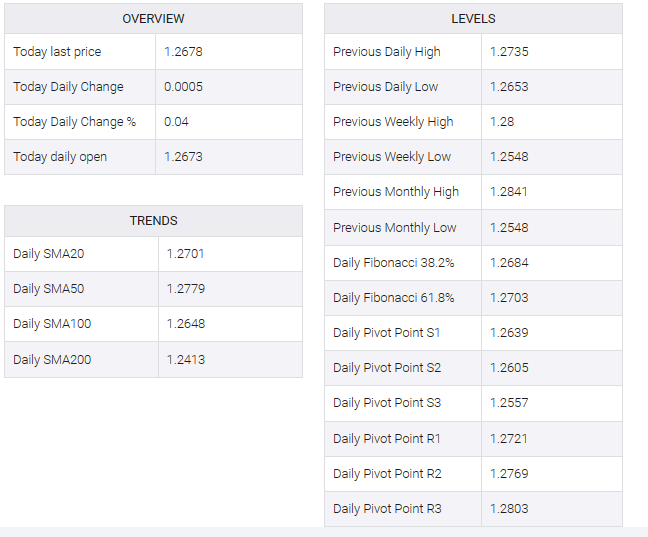

GBP/USD struggles to recover from the previous day’s losses, hovering around 1.2680 during the Asian session on Friday. The pair is under pressure ahead of the releases of employment and manufacturing data from the United States (US).

GBP/USD lost ground due to moderate US data released on Thursday. The US Dollar Index (DXY) is trading higher near 103.60 at the time of writing. As noted, US core PCE improved to an expected 4.2% from 4.1% previously in July. Also, US jobless claims for the week ended August 25 showed a reading of 235K and 228K against the previous market consensus of 232K and indicated that the labor market is still resilient.

However, market participants are taking a cautious stance, seeking fresh impetus to tighten monetary policy at the September meeting of the Bank of England (BoE) and the depressed economic situation in the United Kingdom (UK). The pair faced downward pressure despite hawkish sentiment around a 25 basis point (bps) interest rate hike, following BoE Chief Economist Huw Pill’s hawkish statement on Thursday. Peel opined that the policy should maintain a significant level of restraint for an extended period.

Additionally, the UK’s Financial Conduct Authority (FCA) said in Asia on Friday morning, as reported by Reuters, that an increasingly competitive market is leading to more savings accounts offering higher interest rates. The FCA is working to ensure that British savings account holders can take advantage of higher interest rates faster, as they face rapidly rising costs when borrowing money. The initiative aims to create a balanced and equitable financial environment for consumers.

Investors will likely monitor upcoming US data due out on Friday, looking for more clues about the country’s economic situation. This dataset includes US average hourly earnings, nonfarm payrolls and the ISM manufacturing PMI.