-

GBP/USD licks its wounds after refreshing three-month low.

-

10-week-old descending support line, sluggish MACD signals and the below-50 RSI favor corrective bounce.

-

Convergence of 100-EMA, 38.2% Fibonacci ratio guards immediate recovery of Cable pair.

-

Pound Sterling traders seek directions from US ISM Services PMI amid light calendar at home.

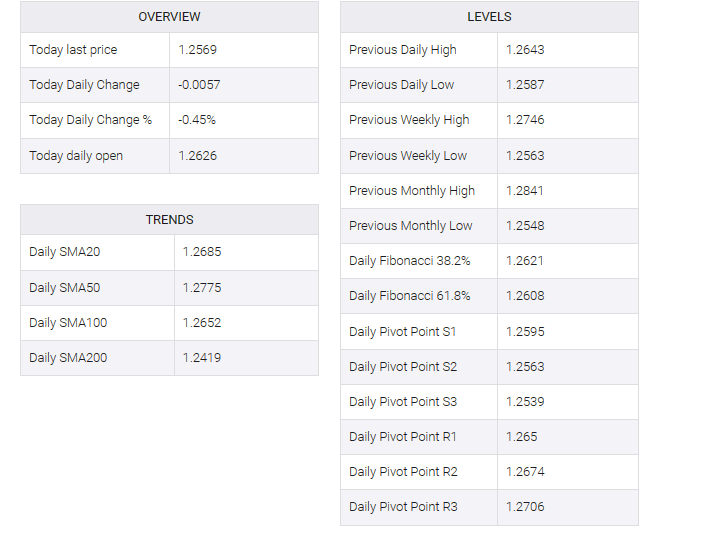

GBP/USD depicted a corrective bounce from the short-term key support line picking a bid at 1.2570 at the start of Wednesday’s trading.

The pair fell to its lowest level since June 13 amid broader US dollar strength before joining the downbeat oscillators to trigger a 2.5-month-long descending trend line bounce. However, a cautious mood ahead of the US ISM Services PMI for August, 52.6 vs. 52.7 previously expected, as well as the final reading of the US S&P Global PMIs for the month, prompted pound sterling traders of late.

Also Read: ISM Services PMI Preview: Strength Could Spook Markets, Boost US Dollar

Given the GBP/USD pair’s rebound from the key support line mentioned above, supported by sluggish MACD signals and sub-50.0 RSI (14) conditions, the quote is likely to move higher.

However, the 100-day exponential moving average (EMA) and the 38.2% Fibonacci retracement to the March-July upside, near 1.2630, will only be an important upside barrier to convince buyers to come back to the table.

After that, a downward-sloping resistance line in late July, near the 1.2700 round figure, will act as the final defense for the GBP/USD bear.

On the contrary, a downward-sloping support line from late June, around 1.2530 by the press time, puts a floor under the GBP/USD price ahead of the 200-EMA support of 1.2490.

In a case where the Pound Sterling remains bearish past 1.2490, the odds of witnessing a slump to the 61.8% Fibonacci retracement level, also known as the Golden Ratio, surrounding 1.2315 can’t be ruled out.

GBP/USD: Daily chart

Trend: Corrective bounce expected