-

GBP/USD tumbles to the psychological support amid a stable US Dollar.

-

A break below the 14-day EMA at 1.2692 could push the pair to approach the major support at 1.2650.

-

Traders would likely await the MACD to confirm the momentum before placing bets.

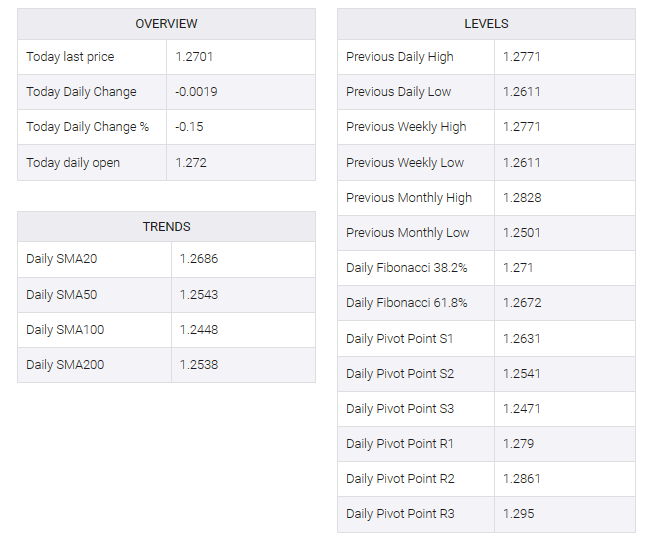

GBP/USD halts its three-day winning streak, trading around 1.2700 psychological level during the Asian session on Monday. The GBP/USD pair seems to face a critical juncture, with the possibility of a break below the psychological level. If this occurs, it could surpass the 14-day Exponential Moving Average (EMA) at 1.2692.

A breach below this support zone could put downward pressure on the GBP/USD pair, potentially navigating it towards key support at 1.2650. This level aligns with the 23.6% Fibonacci retracement at 1.2643, serving as an important area for potential price action.

However, the technical indicator 14-day Relative Strength Index (RSI) is hovering above the 50 level indicating bullish momentum, indicating an upside outlook for the GBP/USD pair.

Additionally, technical analysis of the GBP/USD pair suggests an interesting scenario with the Moving Average Convergence Divergence (MACD) indicator. The MACD line is above the centerline, indicating potential bullish momentum. However, there are deviations below the signal line, suggesting a short scenario. Investors are being cautious and waiting for confirmation from MACD before placing their bets.

On the upside, the 1.2750 level could act as the major barrier followed by the previous week’s high at 1.2771. A breach below the latter could support the GBP/USD pair to explore the region around the psychological level at 1.2800.