-

GBP/USD drifts lower to 1.2682 ahead of UK GDP and US PCE data.

-

The pair keeps the bullish vibe intact above the 100-hour EMA; RSI momentum indicator stands above 50.

-

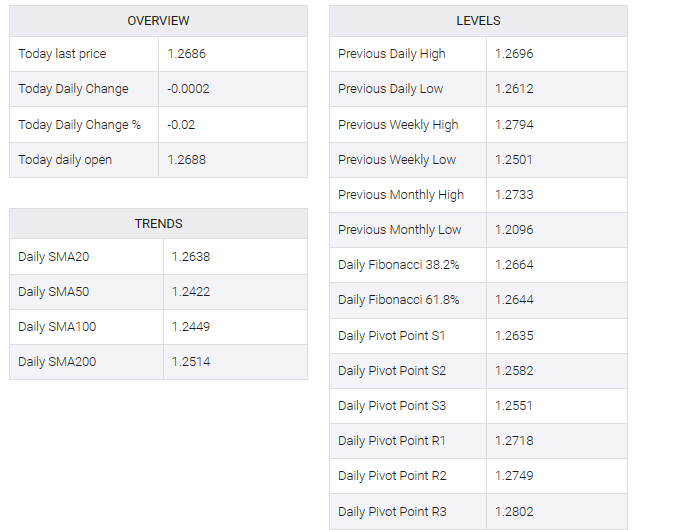

The first resistance level will emerge at 1.2740; 1.2625 acts as a key support level for the pair.

The GBP/USD pair struggled to gain ground in Friday’s early European session. The major pair remains limited below the 1.2700 psychological mark ahead of top-level economic data from both the United Kingdom (UK) and the United States (US). At press time, GBP/USD was trading at 1.2682, down 0.04% on the day.

Technically, GBP/USD maintains a positive outlook as the pair remains above the 100-hour exponential moving average (EMA) on the four-hour chart. Furthermore, the Relative Strength Index (RSI) stands in bullish territory above 50, which looks more favorable to the upside.

The immediate resistance level for the major pair will emerge near the upper boundary of the Bollinger Band at 1.2740, followed by a high of December 19 at 1.2761. The key barrier is seen in the 1.2790–1.2800 region, representing a high of December 15 and the psychological round mark. Further north, the next hurdle to watch is a high of July 28 at 1.2888.

On the downside, the confluence of the 100-hour EMA and a low of December 20 at 1.2625 acts as a critical support level for the pair. Any follow-through selling below the latter will see a drop to to the lower limit of the Bollinger Band at 1.2615. The additional downside filter is located at 1.2544 (low of December 7), en route to 1.2500 (low of December 13, round figure).