-

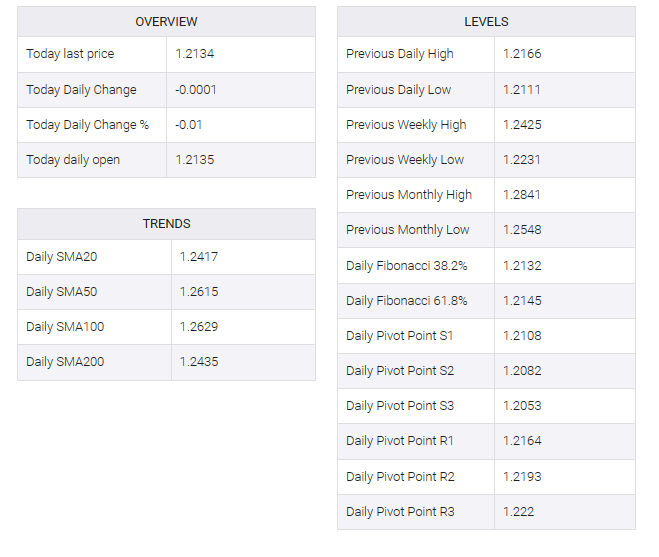

GBP/USD remains under selling pressure around 1.2133, bouncing off the lowest since March 17 of 1.2110.

-

The pair holds below the 50- and 100-hour EMAs with the oversold RSI condition.

-

The key resistance level will emerge at 1.2250; 1.2100 will be the critical support level.

The GBP/USD pair extends its downside for the seventh consecutive day during the Asian session on Thursday. The downtick of the pair is supported by the firmer US Dollar (USD), higher Treasury Yield and upbeat US economic data. The pair currently trades near 1.2133, losing 0.02% on the day.

The Bank of England (BoE) unexpectedly halted its rate hike cycle while the Federal Reserve (Fed) made unexpected comments and hinted that additional rate hikes are possible. Monetary policy divergence between the BoE and the Fed puts pressure on the British Pound (GBP) and acts as a headwind for the GBP/USD pair.

According to the four-hour chart, GBP/USD is below the 50- and 100-hour exponential moving averages (EMAs) with a downward slope, which means the downside looks favorable. The Relative Strength Index (RSI) holds below 50 in bearish territory. However, oversold RSI conditions indicate that further consolidation cannot be ruled out before positioning for any near-term GBP/USD depreciation.

Key resistance levels for GBP/USD will emerge near the upper boundary of the Bollinger Bands and the 50-hour EMA at 1.2250. Additional upside filter is located at 1.2351 (100-hour EMA). The next hurdle to watch is near the September 21 high at 1.2421, followed by a psychological round mark at 1.2500.

On the downside, 1.2100 will be an important support level for the GBP/USD pair. The mentioned level is the confluence of the lower limit of the Bollinger Bands, a psychological figure, and the March 17 low. Further south, the next stop is located at 1.2025 (March 16 low). Any intraday pullback below the latter would reveal the next downside stop at 1.2000 (a circular symbol).