-

GBP/USD grapples to halt the losses despite improved risk aversion.

-

US Dollar could extend its gains on improved US bond yields.

-

British Pound could advance on the expectation of BoE’s hawkish interest rate trajectory.

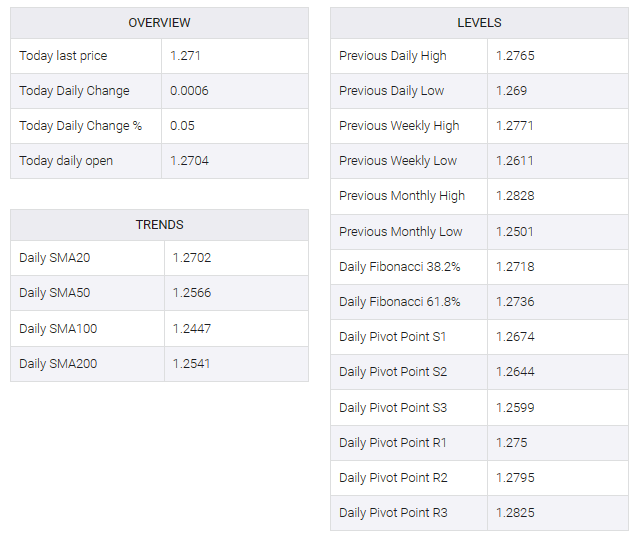

GBP/USD is in focus as it hovers around 1.2710 during the Asian session on Wednesday. The Pound Sterling (GBP) has found support against the US Dollar (USD), following a recent dip that snapped a four-day winning streak. Developed markets’ risk appetite contributed to a weaker US dollar, driven by comments from Federal Reserve (Fed) members about possible rate cuts by the end of 2024. However, a sudden shift in sentiment towards risk aversion is putting pressure on the GBP/USD pair.

The US Dollar Index (DXY) rallied around 102.50 after recent gains, with improved US Treasury yields trying to extend its gains. The 2-year and 10-year yields on US bond coupons stood at 4.36% and 4.02%, respectively, as of press time.

However, risk-on sentiment stemming from comments by members of the Federal Reserve (Fed) expecting to cut interest rates by the end of 2024 put downward pressure on the US dollar. Atlanta Fed President Raphael W. Bostick noted that inflation has slowed more than initially expected and expressed his view of expecting a two-quarter-point decline by the end of 2024.

Additionally, US Fed Governor Michelle W. Bowman noted that the current policy stance appears to be quite restrictive, but that it may be appropriate for the Fed to eventually cut policy rates if inflation is closer to the 2% target.

The GBP/USD pair has shown strength lately, largely driven by monetary policy divergence between the Bank of England (BoE) and the US Federal Reserve (Fed). While indicators such as inflation and wage growth showed signs of easing, the BoE maintained its stance on further rate hikes. In contrast, expectations are building that the Fed may begin an easing cycle as early as March.

DeAnne Julius, a former member of the Bank of England’s (BoE) Monetary Policy Committee, expressed a different view on interest rates. According to him, the Bank of England will not be in a position to start cutting interest rates in 2024. In addition, he noted that rising tensions in the Middle East could potentially lead to a new round of energy price hikes, marking a new beginning. Inflation shock

BoE Governor Andrew Bailey’s speech is due on Wednesday. Furthermore, UK manufacturing production data will be released on Friday, with growth expected to register in November. On the US docket, December consumer price index (CPI) data from the US will be released on Thursday