-

The pound maintains its bearish tone below 1.2600.

-

Today’s main focus is the US Nonfarm Payrolls report.

-

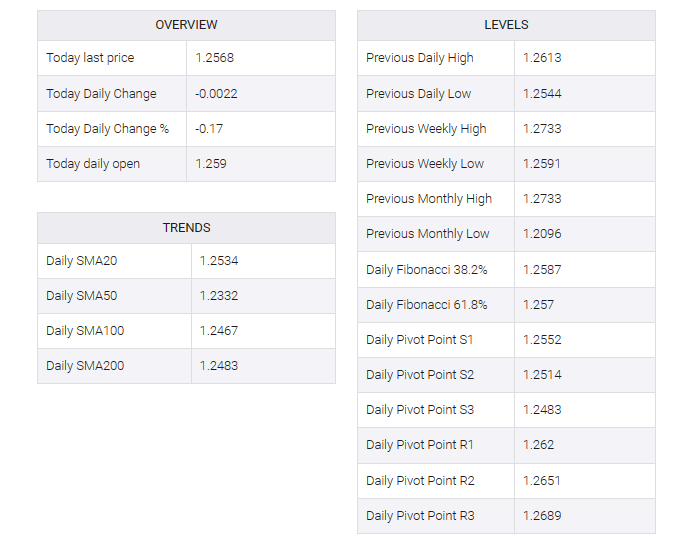

The next downside targets are 1.2515 and 1.2460.

The Pound maintains the weak tone seen over the whole week, with upside attempts capped below the previous support at 1.2600 with all eyes on the US Nonfarm Payrolls report due later today.

The European calendar is light today, with only the UK Consumer inflation expectations worth mentioning. although the impact on the Pound is likely to be minor.

All eyes are on the US Nonfarm Payrolls

Today’s spotlight is on the US nonfarm payrolls report which is expected to show a modest increase in job creation in November. Earlier this week, the US JOLT job opening and ADP employment report disappointed expectations of a Fed rate cut in March 2024, although the US dollar remained moderately bid.

Technical indicators are indicated below. The pair printed a double-top at 1.2730, often a signal of a trend reversal, breaching below the 50-hour SMA and pushing against the 100 SMA in the same timeframe.

The next support levels are 1.2550 and 1.2515 ahead of the aforementioned figure target at 1.2460.

On the upside, a break above 1.2600 would cancel the negative view and shift the focus towards 1.2650 and 1.2730.