-

GBP/USD churns chart paper near 1.2740.

-

UK annualized Nationwide Housing Prices slip, US Chicago PMI also misses.

-

Soft data not shaking out Fed rate cut bets.

The GBP/USD is cycling in near-term congestion as thin post-holiday markets get set to wrap up the last day of trading in 2023, testing back into intraday median prices just above the 1.2700 handle.

UK nationwide house prices fell further than expected in the annual figure, printing 1.4% from forecasts of -1.8% for the year ending December. Markets expected a healthy rebound from the previous period’s -2.0% print. Rising UK economic data is weighing on the pound sterling (GBP), which is largely supported by a broad-market sell-off in the US dollar (USD) as markets bet on faster and deeper rate cuts from the Federal Reserve (Fed). In 2024.

The US Chicago Purchasing Managers’ Index (PMI) fell faster than expected for December, printing a contractionary 46.9, falling short of market forecasts of 51.0 and falling further from November’s 18-month high of 55.8. A worsening U.S. economic outlook is counter-intuitively creating risk appetite across broader markets, as investors look for something to prompt the Fed into its next rate-cutting cycle, which is currently widely expected to begin early next year with the first rate slash in March or April. is expected to occur.

GBP/USD Technical Outlook

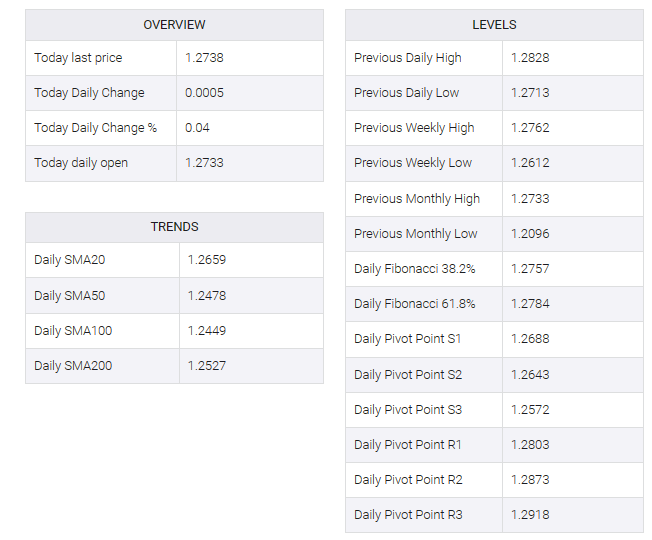

With markets gearing up for the rollover into the 2024 trading year, the GBP/USD is testing into a near-ter midrange as the pair gets squeezed between the 50-hour and 200-hour Simple Moving Averages (SMA) between 1.2760 and the 1.2700 handle.

Daily candlesticks have the GBP/USD struggling to develop real momentum beyond the 1.2700 handle, despite a consistent higher-high/higher-low pattern baked into candles. With most of the pair’s upside momentum coming from broad-market USD short pressure, any recovery in the wider Dollar Index is likely to see a sharp drawdown for the Pound Sterling.