-

GBP/USD halts its losing streak while US Dollar stays calm after a recent surge.

-

IMF Managing Director Kristalina Georgieva expects policy rates to be reduced in 2024 due to a decline in inflation.

-

UK executives urge the BoE to lower interest rates as the Economic Confidence Index fell to 28 from the previous month’s decline of 21.

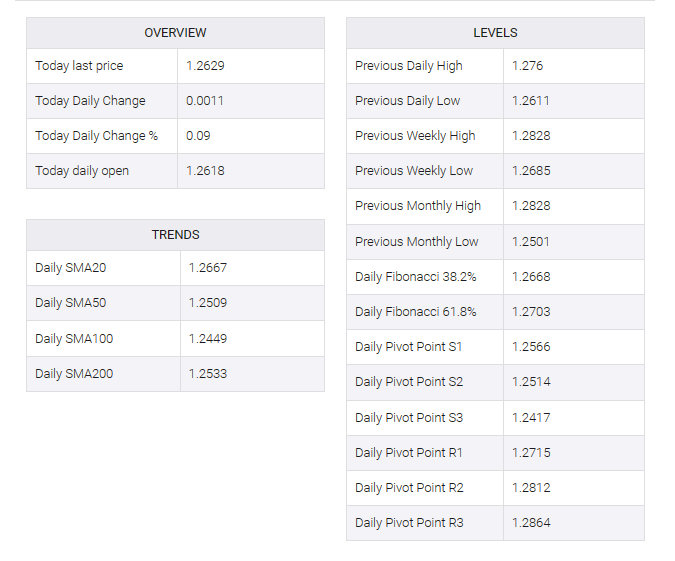

GBP/USD rebounds after posting losses at the previous three successive sessions amid a stable US Dollar (USD). The GBP/USD pair trades higher near 1.2630 during the Asian session on Wednesday. The USD could face downward pressure again on the moderate comments by the International Monetary Fund (IMF) Managing Director Kristalina Georgieva.

In an interview with CNN on Tuesday, IMF Managing Director Georgieva expressed optimism about the US economy, advising Americans to “take heart”. He highlighted that despite a strong labor market, interest rates are expected to moderate in 2024 due to declining inflation. This positive outlook suggests a possible easing of economic pressures and provides a less aggressive outlook on the Federal Reserve’s (Fed) interest rate trajectory.

The US Dollar Index (DXY) could maintain its strength on rising US Treasury yields. The 2-year and 10-year yields on US bond coupons had improved to 4.32% and 3.94%, respectively, by press time. Signs of slower global growth towards the end of 2024 initially led investors to seek refuge in the USD. However, there has been a shift as market players reassess their aggressive bets on the Fed’s impending rate cut.

Pound Sterling (GBP) faces selling pressure due to negative outlook on the British economy. The Institute of Directors’ Economic Confidence Index survey revealed a continued decline in optimism among British managers about the country’s economy over the next 12 months, with the index falling to 28 in December from 21 the previous month. Corporate executives in the United Kingdom (UK) are urging the Bank of England (BoE) to cut interest rates immediately to provide support to the struggling economy.

S&P Global’s commentary also added to the concern, noting that UK manufacturing output contracted at an accelerating rate until the end of 2023. The Bank of England (BoE) is now widely expected to cut interest rates from May 2024, reflecting the view that the UK economy is vulnerable to a technical slowdown.

Wednesday brings US data releases, including December ISM Manufacturing PMI, November JOLTS job openings and Federal Open Market Committee (FOMC) minutes. In the absence of any high-impact data from the UK docket during the week, market participants will be watching low-impact events including the December S&P Global/CIPS Composite PMI and Halifax house prices.