-

GBP/USD attracts some buying on Monday and draws support from a modest USD downtick.

-

Hawkish remarks by BoE’s Broadbent underpin the GBP and act as a tailwind for the major.

-

Bets for one more Fed rate hike in 2023 should limit the USD losses and cap any further gains.

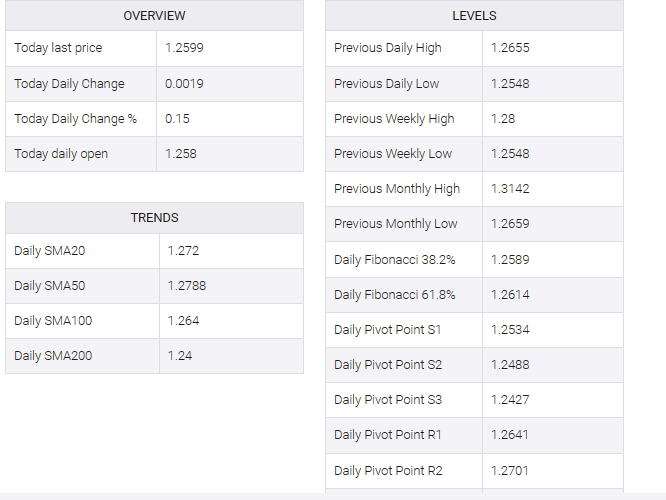

The GBP/USD pair gained some positive traction on the first day of the new week and moved off its lowest level since June 13, hovering around the 1.2550-1.2545 zone on Friday. Spot prices recovered the 1.2600 round-figure mark during the Asian session and attracted support from a moderate US dollar (USD) decline.

China announced on Sunday that tariffs on stock trading would drop from 0.1% to 0.05% from August 28 – marking the first reduction since 2008 – to boost struggling markets. This, in turn, helped revive investor confidence, evident from the generally positive tone around equity markets and led to some profit-taking around the safe-haven greenback, especially after a recent rally to near three-month highs. This, along with dovish comments from Bank of England (BoE) Deputy Governor Ben Broadbent, underpinned the British pound and provided a modest lift to the GBP/USD pair.

Speaking at the annual Jackson Hole Economic Symposium, Broadbent said on Saturday that monetary policy may have to stay in a restrained zone for some time as the knock-on effects of rising prices are unlikely to fade quickly. Market participants, however, are confident that the BoE will not need to raise rates as high as before to bring inflation down to the target given growing recession fears. Indeed, money markets are now pricing in a small possibility of any further rate hikes after the widely expected 25 bps lift-off at the September meeting.

Moreover, Federal Reserve (Fed) Chair Jerome Powell has largely cemented market expectations for one more rate hike by the end of this year. Indeed, Powell said Friday that the Fed may need to raise interest rates further to cool persistently high inflation, and added that policymakers will proceed with caution as they decide whether to tighten further or keep policy rates steady. This supports higher US Treasury bond yields, which could help limit any meaningful downside for the USD and limit further gains for the GBP/USD pair with concerns of a global economic slowdown.

Looking ahead, there is no relevant market-moving economic data to be released on Monday and UK banks will be closed to observe the summer bank holiday. After all, last week’s sustained breakdown through the 100-day Simple Moving Average (SMA) indicates that the path of least resistance for the GBP/USD pair is to the downside. This makes it more prudent to wait for a solid follow-through buy before confirming that the recent downward trend witnessed in the last six weeks has steered its course and positioned for any meaningful appreciative action, at least for the time being.