What is Infinox?

INFINOX was founded in 2009 with a focus on trading solutions and ultimate trading technology while every client is treated as an individual trader and not as an account member.

Infinox was granted a Vantage FX license before launching its own brand. Then, Infinox launched the GO brand while building a strong reputation. Additionally, Infinox received a license for the Vantage FX before launching a brand. After establishing a reputation, the GO brand was launched.

Today, the broker is growing and, while based in the UK with headquarters, offers international proposals through its Bahamas entity.

Pros and Cons of Infinox

Infinox is a trusted broker with an FCA license. They have a good trading platform and technical solution. There are many instruments, including social trading, and spreads that are quite low.

International trading happens via an offshore entity. Therefore, proposals can be different. Also, beginning traders might not have access to comprehensive education and good research tools.

Awards

Infinox has been in operation for over a decade and has seen its expansion and growth. It also received valuable recognition from many authorities and expeditions within the industry.

Is Infinox a safe product or a fraud?

Infinox isn’t a fraud, but it is a FCA-regulated broker that offers low-risk Forex trading and CFDs.

Is Infinox legal?

This is the most important question to ask before you verify the broker. The good news is that Infinox has been regulated and licensed.

Infinox Capital Ltd. is an international company that is Forex Broker and is based in London. It has been fully licensed and regulated under the Financial Conduct Authority (FCA).

Infinox also opened an entity in Bahamas to handle international proposals. Despite not recommending trading with offshore brokers because of the lack of serious regulation there, Infinox considers it a safe broker.

What can you do to be protected?

The regulatory status in a reputable jurisdiction is a significant indicator of trader compliance to security and the overall trading process. Infinox has greatly improved real-time data visibility and instant withdrawals and deposits, in part because transparent pricing and execution are always at the forefront of the business.

Secondly, The Financial Services Compensation Scheme is the UK’s statutory investment insurance. It covers deposits up to PS85,000 and provides negative balance protection so traders can not lose more than what they deposit. It also took out a additional insurance policy of PS500,000 per client. This was underwritten by QBE Underwriting Limited, and other participating syndicates of Lloyd’s of London. INFINOX is also registered with the Commonwealth of the Bahamas. It is licensed and regulated under the Securities Commission of the Bahamas (“the SCB”). INFINOX provides $1,000,000 USD insurance. The policy was in effect from 1 May 2020, and will continue through 30 April 2021. The Policy allows for up to USD 1,000,000 per Claimant. This is subject to the policy’s terms and conditions.

Leverage

- Infinox, a UK-based broker, complies to the FCA offering leverage of up to 1:30 for major currencies pairs, 1:20 minor currencies, and 1:10 commoditiesavailable for European traders or UK traders

- An international proposal with SCB guidance allows for a higher level of up to 1:1200

Although traders used to have higher leverage levels before, the European authorities recently reduced the potential levels due to the risks. Leverage can increase gains, but losses could also be greater than your initial deposit.

It is strongly recommended that you use the tool intelligently and carefully read how to set up the correct leverage to a specific instrument or trading strategy while trading, especially with the international proposal from Infinox.

Types of accounts

INFINOX provides three options for accounts that are optimized for performance. It allows unlimited access to EAs, APIs, and is independent by platform and execution model.

You can choose from Social or MT4 and/or MT5 STP account types. MT4 &/or MT5 ECN are also available. All accounts feature flexible leverage and prices directly from Tier 1 global financial institution.

A broker does not reject a client’s request for price changes, but fills the order at the current price. This is a major distinction to instant execution.

How to open a new account

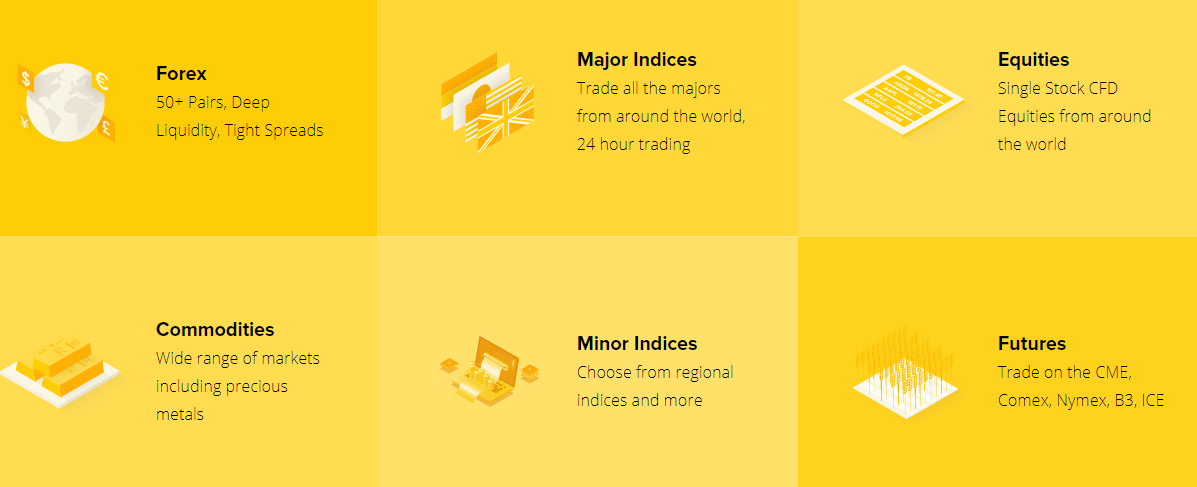

Instruments

The current offering for instruments you can trade through Infinox is 50+ FX pairs, gold and silver, global Top 10 Indices, and Futuresby deal desk neutral, direct real time access to markets via STP or ECN account, as well as the platform you choose to use.

Fees

Infinox fees vary depending on which account type you choose. Conditions may differ according to entity. Due to the execution type and software used, the trading conditions for each account might offer slightly different results. We will provide more information below on each to help you better understand.

Spread

Infinox ECN account offers institutional-grade spreads starting at 0.4 pips with a fixed commission of 7.5$ for every 100k. The minimum trading lot is 0.1. There is no minimum deposit. This makes it an excellent choice for advanced traders and professional traders.

Infinox is a good choice for traders with regular sizes. However, it still offers tight spreads starting at 1.2 pip. There’s no commission and all costs are included. You also get direct access to your account with quick execution.

Below is an example of Infinox spreads on MT4 STP accounts. We list it as a Standard in Infinox Review. You can also compare fees with another UK broker PhillipCapital.

Withdrawals and deposits

Options for deposit

Once you have created an account, you can deposit or withdraw funds using a variety of payment methods such as bank transfer and debit and credit cards, Skrill and Neteller, China Union Pay and Skrill.

However, you should verify the terms and conditions of your jurisdiction and entity.

Infinox minimum deposit

The minimum deposit amount for traders is 1$. This is an excellent opportunity for beginners as well as professionals to join with the amount that you as a trader want to work with.

Withdrawals

Infinox withdraw requests are processed quickly. Once the online submit form has been completed, the funds will be sent to your email address within a few hours. Infinox charges no additional fees for withdrawals. However, you will be charged only the service provider’s fees.

Trade Platforms

As we noticed while reviewing Infinox, one of the main goals of the broker’s is technology speed and efficiency.

Infinox’s partnership with Equinix is a world leader in trading server technology. This gives Infinox a technical edge over the competition and a next-gen pricing tech that connects deep liquidity pools with clients’ MT4 and Mt5 platforms.

Trade Platforms

As we noticed while reviewing Infinox, one of the main goals of the broker’s is technology speed and efficiency.

Infinox’s partnership with Equinix is a world leader in trading server technology. This gives Infinox a technical edge over the competition and a next-generation pricing technology that connects deep liquidity pools with clients’ MT4 or MT5 platforms.

Customer Support

To make communication easier, customer support is available 24/7 in several languages. Overall, we find Infinox Review support to be of a high standard.

Education

The broker has a wide range of tools, analytics, and webinars that enable seamless trades. This is a great. Although we couldn’t find any Infinox Review courses that were required for advanced trading knowledge, there are great analytical tools and research for everyone.

Infinox went further and offered its own project IX Intel, which included articles and a professional analysis of the market. Platforms include a variety of tools, inbuilt news analysis, and social trading capabilities.

Conclusion

Infinox offers reliable online trading services as well as a wide range of quality trading services. Infinox is a FCA broker and has the support of many institutions. Infinox offers progressive technological development that includes transparency in executions. It also provides no-requotes, high speeds, and a wide range of solutions. Infinox works with clients to establish long-term, personal and commercially-focused relationships. This includes contributions in education and client performance enhancement.

| INFINOX Summary | |

|---|---|

| INFINOX Details | Information |

| Regulators | FCA, FSCA, FSC |

| Country |  United Kingdom United Kingdom |

| Base Currencies | EUR, GBP, JPY, AUD, USD |

| Type Of Brokers | CFD |

| Trading Platform | Desktop, Mobile, MT4, MT5 |

| Established Year | 2009 |

| Website Language | English, Chinese |

| US Clients | |

| INFINOX Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.4 |

| Commission | |

| Fixed Spreads | |

| INFINOX Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Visa Card, Visa Card,  Neteller, Neteller,  Skrill, Skrill,  UnionPay, UnionPay,  Wire transfer Wire transfer |

| Acc Withdrawal Methods |  Visa Card, Visa Card,  Neteller, Neteller,  Skrill, Skrill,  Wire transfer, Wire transfer,  UnionPay UnionPay |

| INFINOX Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| INFINOX Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:500 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $100 |

| Islamic Account | |

| INFINOX Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| INFINOX Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +44 (0) 20 3713 4490 |

| support@infinox.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | Birchin Court, 20 Birchin Lane, London, EC3V 9DU, United Kingdom |

South Africa

South Africa Angola

Angola Bulgaria

Bulgaria Mauritius

Mauritius New Zealand

New Zealand Belize

Belize Vanuatu

Vanuatu