-

NZD/USD catches fresh bids on Thursday amid the emergence of fresh selling around the USD.

-

Dovish Fed expectations trigger a fresh leg down in the US bond yields and undermine the buck.

-

Relatively thin liquidity on the back of the US holiday might hold bulls from placing fresh bets.

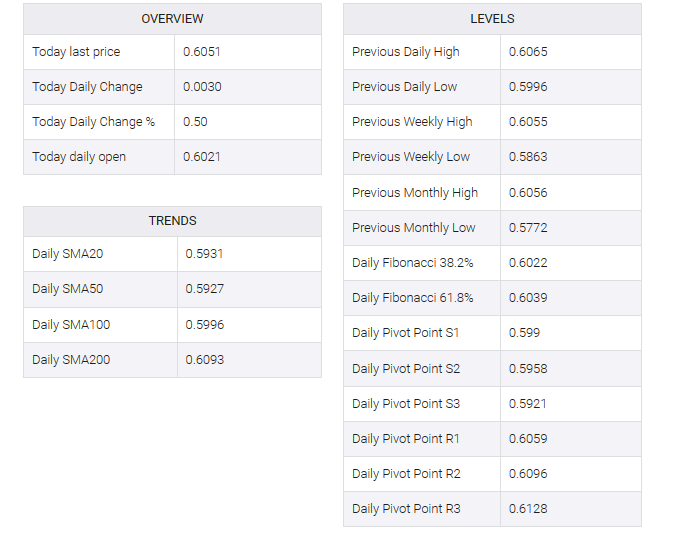

The NZD/USD pair built on an overnight bounce from levels just below the 0.6000 psychological mark and gained strong positive traction in the Asian session on Thursday. Momentum pushed spot prices back to the mid-decade level of 0.6000 in the last hour and was sponsored by the emergence of fresh US dollar (USD) selling.

The USD index (DXY), which tracks the greenback against a basket of currencies, has faced rejection near the 100-day simple moving average (SMA) and, for now, appears to have stalled its two-day-old recovery trend from its lows since August 31. Better-than-expected US labor market data and a rise in consumer inflation expectations gave the greenback a nice lift on Wednesday, although dovish Federal Reserve (Fed) expectations kept a lid on further gains.

In fact, markets have fully priced in the possibility of an interest rate hike by the Fed and see a better than 50% chance of a rate cut by May 2024. This lowers US Treasury bond yields by a new leg, which, along with a flat performance around equity markets, undermines safe havens and benefits risk-sensitive Kiwis. That said, thin liquidity on the back of the US Thanksgiving holiday could prevent bulls from placing new bets around the NZD/USD pair.

Even from a technical perspective, this week’s failure before the 200-day Simple Moving Average (SMA) warrants further caution before positioning for an extension of the appreciative move. In the absence of any relevant market-moving economic data, USD price dynamics will play an important role in influencing the NZD/USD pair. Focus will then be on Friday’s release of quarterly New Zealand retail sales figures, followed by flash US PMI prints after the US session time.