-

NZD/USD drifts lower for the second straight day and retreats further from over a one-month top.

-

A modest USD recovery from its lowest level since February 14 exerts some pressure on the pair.

-

Sliding US bond yields, bets for a less hawkish Fed, a positive risk tone to cap gains for the buck.

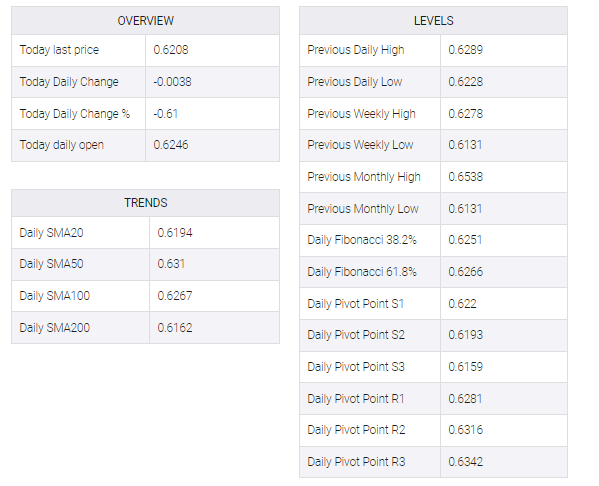

The NZD/USD pair extends the overnight modest pullback from the 0.6280 area, or over a one-month high and continues losing ground for the second successive day on Tuesday. The corrective decline remains uninterrupted through the early European session, with bears now awaiting a sustained weakness below the 0.6200 round-figure mark before placing fresh bets.

The US dollar (USD) regained some positive traction and snapped a three-day losing streak to its lowest level since February 14, which, in turn, appears to be exerting downward pressure on the NZD/USD pair. That said, a fresh leg down in US Treasury bond yields could act as a headwind for the currency, amid slim odds for more aggressive policy tightening by the Federal Reserve (Fed). In addition, a generally positive risk tone may help limit losses for risk-sensitive kiwis, at least for now.

The collapse of two mid-sized US banks – Silicon Valley Bank and Signature Bank – has fueled speculation that the US central bank will soften its hawkish stance to avoid further economic pressure from high-interest rates. Indeed, markets are pricing in a greater possibility of a 25 bps lift-off in March and that the Fed may even cut rates in the second half of the year. As a result, US bond yields tend to drag lower and should put a lid on any meaningful upside for the greenback.

Meanwhile, news that UBS will rescue Credit Suisse in a $3.24 billion deal helped ease fears of wider contagion risks and boost investor confidence. This is evident from further recovery in global equity markets, which erodes traditional safe haven assets and may further contribute to buck capping. Market participants, however, are worried about a full-blown banking crisis. This could prevent traders from positioning for the NZD/USD pair’s recent recovery from the 0.6085 region or its lowest level since November 17 earlier this month.

Going forward, Tuesday’s US economic docket featured the release of existing home sales data and could provide some impetus for the first North American session later. The focus, however, will remain glued on the outcome of the highly anticipated two-day FOMC monetary policy meeting, which will be announced on Wednesday. This will play a key role in influencing near-term USD price dynamics and determine the next step in a directional move for the NZD/USD pair.